/PAlogo_v2.gif) |

|

Post Reply

|

Page 123 11> |

| Author | |

BroSpence

Forum Senior Member

Joined: March 05 2007 Status: Offline Points: 2614 |

Topic: $700 billion from us to save the banks. Good? Topic: $700 billion from us to save the banks. Good?Posted: September 22 2008 at 03:15 |

|

The fed already bailed out Fanny and Freddie and AIG, and ignored Lehman or whatever the name is. Now Bushy wants $700 billion buckaroos to "save the economy" out of our pockets. The same pockets that have been helping to pay for that really really really ridiculously absurd war thing thats at a growing price of....

$556,154,000,000 and then whatever other ridiculous spending that the "conservative" Bush admin has deemed neccessary. Oh those two conventions were on us too. So, the big question(s). Is $700 billion enough or too much? And will it actually make a difference or are we "f'ed" either way. It seems to me that we haven't been good at spending anything or watching big business carefully the past 8 years. And it also seems like the admin wants a huge heap of money without letting us know more details about how it will help us, where its going and all that. So I personally, would rather not help bog our already poor economy down with money we don't have anyways. I also think $700 billion is a lot of money and the price tag should probably come down a bit, but I don't know those details so I guess I couldn't say for sure. |

|

|

|

Jim Garten

Special Collaborator

Retired Admin & Razor Guru Joined: February 02 2004 Location: South England Status: Offline Points: 14693 |

Posted: September 22 2008 at 03:26 Posted: September 22 2008 at 03:26 |

|

I think it's a case of 'fingers-crossed'... last Friday when this news broke (together with new regulation of short-trading brought in by the UK government), the stock market went through the roof with the biggest one day rise in history.

Only time will tell if this is sustainable. |

|

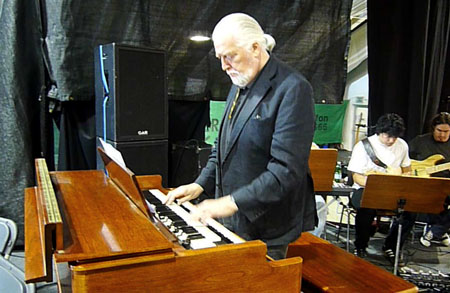

Jon Lord 1941 - 2012 |

|

|

|

Vompatti

Forum Senior Member

VIP Member Joined: October 22 2005 Location: elsewhere Status: Offline Points: 67407 |

Posted: September 22 2008 at 04:27 Posted: September 22 2008 at 04:27 |

|

I'm not familiar with the situation, but in general I think it's against the principles of capitalism for the government to help save any companies. If one bank goes down, there's always another one.

|

|

|

|

Certif1ed

Special Collaborator

Honorary Collaborator Joined: April 08 2004 Location: England Status: Offline Points: 7559 |

Posted: September 22 2008 at 04:51 Posted: September 22 2008 at 04:51 |

|

That money could save a lot of people from starving - but which is more important?

|

|

|

The important thing is not to stop questioning.

|

|

|

|

Atavachron

Special Collaborator

Honorary Collaborator Joined: September 30 2006 Location: Pearland Status: Online Points: 65255 |

Posted: September 22 2008 at 04:59 Posted: September 22 2008 at 04:59 |

|

^ I guess capitalism would theorize the money will save people from starving by providing a platform for jobs ..I think we either have to come to terms with a debt-based economy or reject it.. debt can be a good thing if it allows someone to own a home or send kids to school, but it's all too tempting to just assume everyone will pay it all back when expected, even in a 'good' economy

|

|

|

|

Syzygy

Special Collaborator

Honorary Collaborator Joined: December 16 2004 Location: United Kingdom Status: Offline Points: 7003 |

Posted: September 22 2008 at 05:40 Posted: September 22 2008 at 05:40 |

|

These are the same financial institutions that insist 'You can't interfere with the market' and 'The unseen hand of the market will regulate things'. The first MBA president, his entire administration and the whole edifice of Wall Street either failed to see this coming or knew it was coming but failed to do anything about it.

Still, at least they've learned their lesson, and they're being suitably contrite about it - http://www.independent.co.uk/news/business/news/fury-at-25bn-bonus-for-lehmans-new-york-staff-937560.html

So yes, of course the bail out is a good thing. At least we know that the money will be used wisely.

|

|

|

'Like so many of you

I've got my doubts about how much to contribute to the already rich among us...' Robert Wyatt, Gloria Gloom |

|

|

|

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 22 2008 at 05:55 Posted: September 22 2008 at 05:55 |

|

Generally, the banks are balanced on a financial foundation that is rotten to the core, enormous amounts of virtual money without substance, completely inflated value, if you can call it that. The only way for this to be dealt with cleanly is to let the whole caboodle collapse and replace it with something solid.

This would be a catastrophe for just about everyone, no doubt about it.

But what is being done now is so senseless, it makes me want to bang my head on the table. And a few other heads at well, but those heads are heavily guarded.

Pumping those amounts of money into the banking system is just desperately trying to stabilize a system that is bound to collapse anyway, sooner or later. It's only fighting the symptoms, the cause is still there, and these measures only postpone the inevitable.

I have a gripe against banks anyway; They do what they want because they know that Joe Public is going to have to step in, it's just this Joe Public whom they show the finger to when he comes for a loan of 300 bucks, cap in hand.

Sod the banks the way they are now, and sod the system that supports this!

The money should be used to support the innocent people who are losing everything because of the banks, and not the banks that are the root of all this. Stabilise the banks and see where it's going to leave Joe Public. Back in the dirt, that's where! Edited by npjnpj - September 22 2008 at 06:03 |

|

|

|

Atavachron

Special Collaborator

Honorary Collaborator Joined: September 30 2006 Location: Pearland Status: Online Points: 65255 |

Posted: September 22 2008 at 05:58 Posted: September 22 2008 at 05:58 |

|

but eventually aren't we headed to a mostly non-cash system where everything is virtual?

|

|

|

|

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 22 2008 at 06:01 Posted: September 22 2008 at 06:01 |

|

Yes, but even so this virtual money should represent some production unit or service at the end of the chain. There is hardly any counter-value in the system as it is now.

Edited by npjnpj - September 22 2008 at 06:02 |

|

|

|

Passionist

Forum Senior Member

Joined: March 14 2005 Location: Finland Status: Offline Points: 1119 |

Posted: September 22 2008 at 07:32 Posted: September 22 2008 at 07:32 |

|

It's true, most of our money is not there. It's just imaginary, numbers on a piece of paper. Not like with Scrooge McDuck, who swims in his own. The money isn't stored in the banks dungeons, and there's no point in robbing them anymore. Banks only have little cash physically placed in them. When you make a deposit and leave your cash in the bank, it is immediately transferred to global stockmarket, where it will be invested in order to make more money, firstly to the bank itself and then to you as what they call the interest. It's a tough decision. 7 billion could as far as I know save the state of affairs or it could double the inflation. No such measure has taken place in the history, so this would be the first one, thoguh HUGE. we know already, that what money loses its value, as it is going to now, banks will go corrupt. And in the early 90s in Finland for example, a lot of companies/corporations that had their money invested in certain banks survived. A lot of banks went corrupt and along them a lot of people and businesses, all lost their savings. And the state could only help those that it could with a low budget, because at that point there was no money to be collected. So a few survived. One or two banks, some big corporations and the rich because they had so much to begin with. So with inflation the value of the currency decreases, meaning, that there's a lot of money about, but it's not worth anything. We all know what happened in Germany in the early 20th century, or what's going on in Zimbabwe right now, where inflation is at 100000%. Drawing physical money from the people is an inevitable measure. As long as everyone still has that money, there's no possibility the value of it would grow back to where it was a few years back. Otherwise everyone would be rich, and the prices would go up again, and... wait, that's just what's happening now. I think paying the sum is inevitable, but I'm not sure if 7 billion is the right amount. I'd like to hear some arguments behind it, but I for one can't make better suggestions. They've got professional economists counting the amount, and I believe in them more than in the average Joe Public who only knows the name of his dog. One option, of course would be to close the international/national stock market and prevent income from all the corporations that are part of this cycle. And in the end, it's only 20 bucks per person. |

|

|

|

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 22 2008 at 07:48 Posted: September 22 2008 at 07:48 |

|

I'm not really a great believer in conspiracies (apart from 9/11, say) but over time I've learnt to sit back and when it's all over, view the end result and wonder if that's what was planned somehow.

What I'm seeing at this time is that a lot of banks are either vanishing or being integrated in a handful of vast banking houses with absolutely not cartel restrictions, all in the name of panic.

Sure, we're in the middle of the thing at the moment, but I feel very uneasy, watching the rise of these newly structured banks with hardly and competition to take into consideration, meaning that these houses will have the power to do whatever they want in the future.

Could this be a GIGANTIC scam?

Got to go back to my padded cell now.l Edited by npjnpj - September 22 2008 at 07:49 |

|

|

|

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 22 2008 at 13:05 Posted: September 22 2008 at 13:05 |

|

Savings and Loan crisis deja-vu. Take away responsible regulations. Privatize the profits and to the public goes the losses when the crap hits the fan.

http://www.thismodernworld.com/ "September 22, 2008

Jonathan Schwarz:

Write and call your representative and senators plus Nancy Pelosi and Steny Hoyer this morning and tell them to tell the Bush administration NO on their proposed $700 billion handout to Wall Street. Congress obviously can propose a much better plan of its own, but the first thing to do is kill this monstrosity. Congress main line Nancy Pelosi Steny Hoyer Uncategorized | --> posted by

Jonathan Schwarz

at 6:51 AM | link"

" Jonathan Schwarz:

Uncategorized | --> Edited by Slartibartfast - September 22 2008 at 13:22 |

|

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|

|

|

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 22 2008 at 13:12 Posted: September 22 2008 at 13:12 |

|

A bitter pill, surely something we all should be pissed off about, but better than the alternative.

|

|

|

|

rushfan4

Special Collaborator

Honorary Collaborator Joined: May 22 2007 Location: Michigan, U.S. Status: Offline Points: 66262 |

Posted: September 22 2008 at 13:15 Posted: September 22 2008 at 13:15 |

|

I suppose it all depends on what funny business has gone on. Maybe an evaluation of the executive's finances needs to be done by our friendly neighborhood Federal Bureau of Investigations, and if it appears that some of the more unscrupulous types have 4 or 5 too many homes, airplanes, yachts, sports cars, then these individuals should face the same spotlight as our former Enron buddies, and they should also be made to foot the bill.

|

|

|

|

|

|

micky

Special Collaborator

Honorary Collaborator Joined: October 02 2005 Location: . Status: Offline Points: 46833 |

Posted: September 22 2008 at 22:24 Posted: September 22 2008 at 22:24 |

|

I must admit... I live my life... with my head in the clouds... with concerns a bit more down to earth and revolving around Raff and ending this two year plus odyssey to have a life together (soon to be over btw)

however... I had heard of this... but spent an education hour at dinner tonight watching Lou Dobbs on CNN... jesus christ... I am no economist....but those that are... are genuinely.. and DEEPLY concerned.... this is no laughing matter.... when words about econonic collapse are being thrown around... that gets your attention. To be honest... I had foreseen, or believed in, the end of 'Pax Americana' but figured I'd be in the ground when that happened.. hmmmm.... we have a real mess here.... someone is going to have to pay for that... and that is going to be us.... you all.... the government is not going to eat that... it can't afford to. f**king great.... |

|

|

The Pedro and Micky Experience - When one no longer requires psychotropics to trip

|

|

|

|

Finnforest

Special Collaborator

Honorary Collaborator Joined: February 03 2007 Location: The Heartland Status: Offline Points: 16913 |

Posted: September 22 2008 at 22:45 Posted: September 22 2008 at 22:45 |

|

It makes me so angry I really can't articulate anything but rage.

As Brian says, they want all the profits, no regulation, privatize this and free-market that. But when it all goes to hell because of their greed, then government is GOOD all of a sudden. Then they're right in line for a hand-out like the welfare folks they hate. The hypocrisy is stunning, just beyond belief. Oh yeah, and Bush says that no "punitive measures" should be allowed in the bill. That's right, give them taxpayer dollars to reward their colossal f-ck up, but no, you can't punish anyone. Maybe it's necessary, who knows, that's not the point of my post. The point is that these people should get called on their behavior rather than rewarded for it, and I don't really hear that happening in the media or in congress yet. Those that broke laws or rules should also have their profits for the last few years taken back and be thrown out of the banking business--in a fair world. I hope a few Reps and Sens speak out. Naivety. Sure. Just pissed off over this. |

|

|

|

micky

Special Collaborator

Honorary Collaborator Joined: October 02 2005 Location: . Status: Offline Points: 46833 |

Posted: September 22 2008 at 22:55 Posted: September 22 2008 at 22:55 |

|

|

|

The Pedro and Micky Experience - When one no longer requires psychotropics to trip

|

|

|

|

stonebeard

Forum Senior Member

Joined: May 27 2005 Location: NE Indiana Status: Offline Points: 28057 |

Posted: September 22 2008 at 22:58 Posted: September 22 2008 at 22:58 |

|

I can has new revolution?

|

|

|

|

Atkingani

Special Collaborator

Honorary Collaborator / Retired Admin Joined: October 21 2005 Location: Terra Brasilis Status: Offline Points: 12288 |

Posted: September 22 2008 at 23:28 Posted: September 22 2008 at 23:28 |

|

Who's going to pay the bill?

|

|

|

Guigo

~~~~~~ |

|

|

|

BroSpence

Forum Senior Member

Joined: March 05 2007 Status: Offline Points: 2614 |

Posted: September 23 2008 at 00:12 Posted: September 23 2008 at 00:12 |

|

Isn't it interesting that the Fed. Reserve was partially created to help prevent our banks from failing and all that, then the great depression happened a few years later.

Anyways, I just sent a bunch of Emails to representatives. |

|

|

|

Post Reply

|

Page 123 11> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |