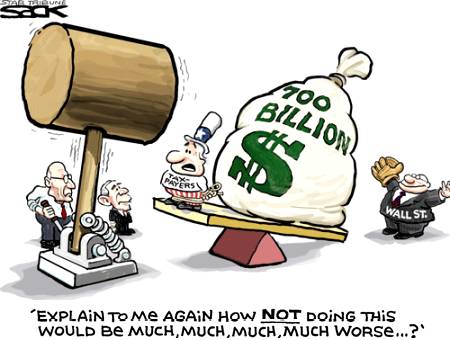

$700 billion from us to save the banks. Good?

Printed From: Progarchives.com

Category: Topics not related to music

Forum Name: General discussions

Forum Description: Discuss any topic at all that is not music-related

URL: http://www.progarchives.com/forum/forum_posts.asp?TID=51967

Printed Date: November 23 2024 at 05:20

Software Version: Web Wiz Forums 11.01 - http://www.webwizforums.com

Topic: $700 billion from us to save the banks. Good?

Posted By: BroSpence

Subject: $700 billion from us to save the banks. Good?

Date Posted: September 22 2008 at 03:15

|

The fed already bailed out Fanny and Freddie and AIG, and ignored Lehman or whatever the name is. Now Bushy wants $700 billion buckaroos to "save the economy" out of our pockets. The same pockets that have been helping to pay for that really really really ridiculously absurd war thing thats at a growing price of....

$556,154,000,000 and then whatever other ridiculous spending that the "conservative" Bush admin has deemed neccessary. Oh those two conventions were on us too. So, the big question(s). Is $700 billion enough or too much? And will it actually make a difference or are we "f'ed" either way. It seems to me that we haven't been good at spending anything or watching big business carefully the past 8 years. And it also seems like the admin wants a huge heap of money without letting us know more details about how it will help us, where its going and all that. So I personally, would rather not help bog our already poor economy down with money we don't have anyways. I also think $700 billion is a lot of money and the price tag should probably come down a bit, but I don't know those details so I guess I couldn't say for sure. |

Replies:

Posted By: Jim Garten

Date Posted: September 22 2008 at 03:26

|

I think it's a case of 'fingers-crossed'... last Friday when this news broke (together with new regulation of short-trading brought in by the UK government), the stock market went through the roof with the biggest one day rise in history.

Only time will tell if this is sustainable. -------------

Jon Lord 1941 - 2012 |

Posted By: Vompatti

Date Posted: September 22 2008 at 04:27

| I'm not familiar with the situation, but in general I think it's against the principles of capitalism for the government to help save any companies. If one bank goes down, there's always another one. |

Posted By: Certif1ed

Date Posted: September 22 2008 at 04:51

|

That money could save a lot of people from starving - but which is more important? ------------- The important thing is not to stop questioning. |

Posted By: Atavachron

Date Posted: September 22 2008 at 04:59

|

^ I guess capitalism would theorize the money will save people from starving by providing a platform for jobs ..I think we either have to come to terms with a debt-based economy or reject it.. debt can be a good thing if it allows someone to own a home or send kids to school, but it's all too tempting to just assume everyone will pay it all back when expected, even in a 'good' economy |

Posted By: Syzygy

Date Posted: September 22 2008 at 05:40

|

These are the same financial institutions that insist 'You can't interfere with the market' and 'The unseen hand of the market will regulate things'. The first MBA president, his entire administration and the whole edifice of Wall Street either failed to see this coming or knew it was coming but failed to do anything about it.

Still, at least they've learned their lesson, and they're being suitably contrite about it - http://www.independent.co.uk/news/business/news/fury-at-25bn-bonus-for-lehmans-new-york-staff-937560.html - http://www.independent.co.uk/news/business/news/fury-at-25bn-bonus-for-lehmans-new-york-staff-937560.html

So yes, of course the bail out is a good thing. At least we know that the money will be used wisely. ------------- 'Like so many of you I've got my doubts about how much to contribute to the already rich among us...' Robert Wyatt, Gloria Gloom |

Posted By: npjnpj

Date Posted: September 22 2008 at 05:55

|

Generally, the banks are balanced on a financial foundation that is rotten to the core, enormous amounts of virtual money without substance, completely inflated value, if you can call it that. The only way for this to be dealt with cleanly is to let the whole caboodle collapse and replace it with something solid.

This would be a catastrophe for just about everyone, no doubt about it.

But what is being done now is so senseless, it makes me want to bang my head on the table. And a few other heads at well, but those heads are heavily guarded.

Pumping those amounts of money into the banking system is just desperately trying to stabilize a system that is bound to collapse anyway, sooner or later. It's only fighting the symptoms, the cause is still there, and these measures only postpone the inevitable.

I have a gripe against banks anyway; They do what they want because they know that Joe Public is going to have to step in, it's just this Joe Public whom they show the finger to when he comes for a loan of 300 bucks, cap in hand.

Sod the banks the way they are now, and sod the system that supports this!

The money should be used to support the innocent people who are losing everything because of the banks, and not the banks that are the root of all this. Stabilise the banks and see where it's going to leave Joe Public. Back in the dirt, that's where!

|

Posted By: Atavachron

Date Posted: September 22 2008 at 05:58

|

but eventually aren't we headed to a mostly non-cash system where everything is virtual? |

Posted By: npjnpj

Date Posted: September 22 2008 at 06:01

| Yes, but even so this virtual money should represent some production unit or service at the end of the chain. There is hardly any counter-value in the system as it is now. |

Posted By: Passionist

Date Posted: September 22 2008 at 07:32

|

It's true, most of our money is not there. It's just imaginary, numbers on a piece of paper. Not like with Scrooge McDuck, who swims in his own. The money isn't stored in the banks dungeons, and there's no point in robbing them anymore. Banks only have little cash physically placed in them. When you make a deposit and leave your cash in the bank, it is immediately transferred to global stockmarket, where it will be invested in order to make more money, firstly to the bank itself and then to you as what they call the interest. It's a tough decision. 7 billion could as far as I know save the state of affairs or it could double the inflation. No such measure has taken place in the history, so this would be the first one, thoguh HUGE. we know already, that what money loses its value, as it is going to now, banks will go corrupt. And in the early 90s in Finland for example, a lot of companies/corporations that had their money invested in certain banks survived. A lot of banks went corrupt and along them a lot of people and businesses, all lost their savings. And the state could only help those that it could with a low budget, because at that point there was no money to be collected. So a few survived. One or two banks, some big corporations and the rich because they had so much to begin with. So with inflation the value of the currency decreases, meaning, that there's a lot of money about, but it's not worth anything. We all know what happened in Germany in the early 20th century, or what's going on in Zimbabwe right now, where inflation is at 100000%. Drawing physical money from the people is an inevitable measure. As long as everyone still has that money, there's no possibility the value of it would grow back to where it was a few years back. Otherwise everyone would be rich, and the prices would go up again, and... wait, that's just what's happening now. I think paying the sum is inevitable, but I'm not sure if 7 billion is the right amount. I'd like to hear some arguments behind it, but I for one can't make better suggestions. They've got professional economists counting the amount, and I believe in them more than in the average Joe Public who only knows the name of his dog. One option, of course would be to close the international/national stock market and prevent income from all the corporations that are part of this cycle. And in the end, it's only 20 bucks per person. |

Posted By: npjnpj

Date Posted: September 22 2008 at 07:48

|

I'm not really a great believer in conspiracies (apart from 9/11, say) but over time I've learnt to sit back and when it's all over, view the end result and wonder if that's what was planned somehow.

What I'm seeing at this time is that a lot of banks are either vanishing or being integrated in a handful of vast banking houses with absolutely not cartel restrictions, all in the name of panic.

Sure, we're in the middle of the thing at the moment, but I feel very uneasy, watching the rise of these newly structured banks with hardly and competition to take into consideration, meaning that these houses will have the power to do whatever they want in the future.

Could this be a GIGANTIC scam?

Got to go back to my padded cell now.l

|

Posted By: Slartibartfast

Date Posted: September 22 2008 at 13:05

|

Savings and Loan crisis deja-vu. Take away responsible regulations. Privatize the profits and to the public goes the losses when the crap hits the fan. http://www.thismodernworld.com/ - http://www.thismodernworld.com/ "September 22, 2008

Jonathan Schwarz:

http://thismodernworld.com/4479 - -->NO

Write and call your representative and senators plus Nancy Pelosi and Steny Hoyer this morning and tell them to tell the Bush administration NO on their proposed $700 billion handout to Wall Street. Congress obviously can propose a much better plan of its own, but the first thing to do is kill this monstrosity. Congress main line https://forms.house.gov/wyr/welcome.shtml - Write your representative http://www.senate.gov/general/contact_information/senators_cfm.cfm - Write your senators Nancy Pelosi Steny Hoyer http://thismodernworld.com/category/uncategorized/ - Uncategorized | --> posted by

http://tinyrevolution.com/mt/ - Jonathan Schwarz

at 6:51 AM http://thismodernworld.com/4479 - | link"

" Jonathan Schwarz:

http://thismodernworld.com/4475 - -->Greider: “Bailout Plan A Historic Swindle”

http://www.thenation.com/doc/20081006/greider - link

http://www.thenation.com/doc/20081006/greider - The rest. http://thismodernworld.com/category/uncategorized/ - Uncategorized | --> posted by

http://tinyrevolution.com/mt/ - Jonathan Schwarz

at 1:27 PM http://thismodernworld.com/4475 - | link "

------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: Padraic

Date Posted: September 22 2008 at 13:12

| A bitter pill, surely something we all should be pissed off about, but better than the alternative. |

Posted By: rushfan4

Date Posted: September 22 2008 at 13:15

|

I suppose it all depends on what funny business has gone on. Maybe an evaluation of the executive's finances needs to be done by our friendly neighborhood Federal Bureau of Investigations, and if it appears that some of the more unscrupulous types have 4 or 5 too many homes, airplanes, yachts, sports cars, then these individuals should face the same spotlight as our former Enron buddies, and they should also be made to foot the bill. -------------

|

Posted By: micky

Date Posted: September 22 2008 at 22:24

|

I must admit... I live my life... with my head in the clouds... with concerns a bit more down to earth and revolving around Raff and ending this two year plus odyssey to have a life together (soon to be over btw) however... I had heard of this... but spent an education hour at dinner tonight watching Lou Dobbs on CNN... jesus christ... I am no economist....but those that are... are genuinely.. and DEEPLY concerned.... this is no laughing matter.... when words about econonic collapse are being thrown around... that gets your attention. To be honest... I had foreseen, or believed in, the end of 'Pax Americana' but figured I'd be in the ground when that happened.. hmmmm.... we have a real mess here.... someone is going to have to pay for that... and that is going to be us.... you all.... the government is not going to eat that... it can't afford to. f**king great.... ------------- The Pedro and Micky Experience - When one no longer requires psychotropics to trip |

Posted By: Finnforest

Date Posted: September 22 2008 at 22:45

|

It makes me so angry I really can't articulate anything but rage. As Brian says, they want all the profits, no regulation, privatize this and free-market that. But when it all goes to hell because of their greed, then government is GOOD all of a sudden. Then they're right in line for a hand-out like the welfare folks they hate. The hypocrisy is stunning, just beyond belief. Oh yeah, and Bush says that no "punitive measures" should be allowed in the bill. That's right, give them taxpayer dollars to reward their colossal f-ck up, but no, you can't punish anyone. Maybe it's necessary, who knows, that's not the point of my post. The point is that these people should get called on their behavior rather than rewarded for it, and I don't really hear that happening in the media or in congress yet. Those that broke laws or rules should also have their profits for the last few years taken back and be thrown out of the banking business--in a fair world. I hope a few Reps and Sens speak out. Naivety. Sure. Just pissed off over this. |

Posted By: micky

Date Posted: September 22 2008 at 22:55

------------- The Pedro and Micky Experience - When one no longer requires psychotropics to trip |

Posted By: stonebeard

Date Posted: September 22 2008 at 22:58

|

I can has new revolution?

------------- http://soundcloud.com/drewagler" rel="nofollow - My soundcloud. Please give feedback if you want! |

Posted By: Atkingani

Date Posted: September 22 2008 at 23:28

|

Who's going to pay the bill? ------------- Guigo ~~~~~~ |

Posted By: BroSpence

Date Posted: September 23 2008 at 00:12

|

Isn't it interesting that the Fed. Reserve was partially created to help prevent our banks from failing and all that, then the great depression happened a few years later.

Anyways, I just sent a bunch of Emails to representatives. |

Posted By: KoS

Date Posted: September 23 2008 at 00:23

|

Just seems like Paulson's looking out for his and his friends interests first than the public. I mean this guy was a former Goldman Sachs guy. |

Posted By: Slartibartfast

Date Posted: September 23 2008 at 12:54

You might be interested in this: http://www.gata.org/node/6469 - http://www.gata.org/node/6469 "William Greider: The Fed is the problem, not the solutionSubmitted by cpowell on Mon, 2008-08-04 18:36. Section: http://www.gata.org/taxonomy/term/2 - Daily DispatchesEconomic Free-Fall? By William Greider http://www.thenation.com/doc/20080818/greider - http://www.thenation.com/doc/20080818/greider Washington can act with breathtaking urgency when the right people want something done. In this case, the people are Wall Street's titans, who are scared witless at the prospect of their historic implosion. Congress quickly agreed to enact a gargantuan bailout, with more to come, to calm the anxieties and halt the deflation of Wall Street giants. Put aside partisan bickering, no time for hearings, no need to think through the deeper implications. We haven't seen "bipartisan cooperation" like this since Washington decided to invade Iraq. In their haste to do anything the financial guys seem to want, Congress and the lame-duck President are, I fear, sowing far more profound troubles for the country. First, while throwing our money at Wall Street, government is neglecting the grave risk of a deeper catastrophe for the real economy of producers and consumers. Second, Washington's selective generosity for influential financial losers is deforming democracy and opening the path to an awesomely powerful corporate state. Third, the rescue has not succeeded, not yet. Banking faces huge losses ahead, and informed insiders assume a far larger federal bailout will be needed -- after the election. No one wants to upset voters by talking about it now. The next President, once in office, can break the bad news..." and this: " Secrets of the Temple: How the Federal Reserve Runs the Country (Paperback)by http://www.amazon.com/exec/obidos/search-handle-url/ref=ntt_athr_dp_sr_1?%5Fencoding=UTF8&search-type=ss&index=books&field-author=William%20Greider - William Greider (Author) "In the American system, citizens were taught that the transfer of political power accompanied elections, formal events when citizens made orderly choices about who shall..." ( http://www.amazon.com/gp/reader/0671675567/ref=sib_fs_top?ie=UTF8&p=S00C&checkSum=6cDshnl5qajrIA3iPbClUzWn0umRmd7GLz%2Bz9SbfYM8%3D#reader-link - more )"It's a book that's been out for a while and really really long read. I'm not sure if I ever finished it. ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: Padraic

Date Posted: September 23 2008 at 13:44

Very good article, agreed with a lot of the suggestions. |

Posted By: Padraic

Date Posted: September 23 2008 at 14:01

Hey Slart since you're the expert in such things, I'd love to see some good spoofs on "Don't worry honey, we're with AIG"

|

Posted By: crimhead

Date Posted: September 23 2008 at 15:07

| Where are we to stop at these bailouts? I think that any executive compensation should be taken off of the table as well. When was the last time that anyone walked into a Bankruptcy hearing to have the judge say that your debts are wiped out and by the way here's a couple million dollars for a job well done? Never. If these companies are bailed out the the execs at the top should get nothing. |

Posted By: Padraic

Date Posted: September 23 2008 at 15:10

agree completely! most of them should consider themselves lucky to avoid a prison sentence! |

Posted By: Slartibartfast

Date Posted: September 23 2008 at 15:19

Sorry, I'm a bit lazy and only post stuff I run in to or can dig up easily. I'm sure some AIG thingys will come up soon... And by the way, I almost got hit by a single engine Piper, can't you see I've got better things to do than that (?) and anyways, I really need to get back to work. http://www.myfoxatlanta.com/myfox/pages/Home/Detail?contentId=7494985&version=11&locale=EN-US&layoutCode=TSTY&pageId=1.1.1 - http://www.myfoxatlanta.com/myfox/pages/Home/Detail?contentId=7494985&version=11&locale=EN-US&layoutCode=TSTY&pageId=1.1.1  A small plane crashed in a DeKalb County neighborhood Tuesday afternoon. MORE INFO http://www.wsbtv.com/news/17539466/detail.html#">------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: Syzygy

Date Posted: September 23 2008 at 16:49

They get paid for their expertise. If you don't give them bonuses, they'll take that valuable expertise somewhere else

On second thoughts, although I was being heavily sarcastic there, that's probably exactly what would happen. 'You were part of the team that steered Lehman's into bankruptcy and the economy of the nation towards a depression? We'll double your salary and shampoo your stair carpets for you while we're at it.' ------------- 'Like so many of you I've got my doubts about how much to contribute to the already rich among us...' Robert Wyatt, Gloria Gloom |

Posted By: Atkingani

Date Posted: September 23 2008 at 18:42

|

We heard here that a bunch of Lehman Brothers executives are demanding their benefits for the succesful operations they held in the past couple of years... ------------- Guigo ~~~~~~ |

Posted By: crimhead

Date Posted: September 23 2008 at 19:15

The only other way that we the people can get back at them is to sue the Board of Directors. But then again they got to have their money squirelled away somewhere that we cannot get at.

|

Posted By: rushfan4

Date Posted: September 23 2008 at 23:05

|

Breaking news on the local news tonight the FBI is beginning a fraud investigation investigating individuals involved with Lehman Brothers, Fannie Mae, and other failed mortgage institutions. Here's hoping that some well deserving individuals take the fall for it.

Also, most likely with bankruptcy court, what will happen is bankruptcy attorneys and turnaround experts will be charged with turning around these businesses. These people will be the ones to make big dollars from this. Although, I wouldn't be surprised if former executives will go away with their golden parachutes. -------------

|

Posted By: rushfan4

Date Posted: September 23 2008 at 23:09

|

They also said that the bailout amounts to $10,000 per household. Personally, instead of giving $700 billion to Wall Street I would prefer that they write me a check for $10,000. I suspect I could do some pretty good damage with $10,000. -------------

|

Posted By: BroSpence

Date Posted: September 24 2008 at 01:09

|

Per person in the US I think its something around $2333. Which isn't much if you're buying a car, however that check isn't going to pay your own bills. Its going to someone who f***ed up.

Both are quite interesting. Thank you. I assume you are aware of the conspiracy theories that are related to the Fed as well? |

Posted By: Slartibartfast

Date Posted: September 24 2008 at 07:36

Not too well.    ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: debrewguy

Date Posted: September 24 2008 at 15:12

|

I'm still saying give it directly to the American Public on a declining income curve. But use about 1 billion to go after the execs, CEOs, and investment denizens who sold investors a bill of goods (guaranteed, no risk); along with re-stating the books to show the REAL profit; then re-claiming any phony performance bonuses, along with any dividends paid out on non-existent profits. And as far as this last little bit hurting the investors, well, there is supposed to be a correlation between risk & return. SO if you took a risk to hopefully get a higher return, should you not be open to the downside ? Oh, wait, that would wreck the American economy, by penalizing those that had the money to invest. No mention need be made to those who don't have the means to invest and did not profit from the Ponzi scheme, but will shoulder their share of the burden for the bailout. ------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: Padraic

Date Posted: September 24 2008 at 15:24

Give what? I don't understand what you're talking about. |

Posted By: Slartibartfast

Date Posted: September 24 2008 at 16:05

|

Give it a moment, we're talking about the bail out funds here. If you put the funds in the pockets of the wealthy people responsible for this mess, you'll not only reward them for bad behavior and poor investment decisions, but you won't be putting money in the pockets of those who would use it most to benefit the economy: people who've seen their wages decline or jobs shipped abroad. There's always going to be rich folks in any economy and I can even buy into the argument that they are necessary. Unfortunately they've been allowed to become parasitical and will kill the host if not reigned in.

------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: Padraic

Date Posted: September 24 2008 at 18:56

|

The bail out funds come from the American public, or rather that we borrow the money and need to pay it back. No one is happy about the proposed plan, but almost every economist agrees that failure to act and shore up the financial/credit system will hurt so much more - the most pain going to the "little guy" if businesses start failing. And in the future, you don't need to be so condescending. I was making a good faith effort for debrewguy to clarify his post. I assure you I'm not as stupid as you think I am. |

Posted By: Slartibartfast

Date Posted: September 24 2008 at 19:29

Sincere apologies if I came across as condescending. Was not my intent. OK maybe just a little. You obviously take this as seriously as I do. Unfortunately, I feel we sometimes live in the United States of Amnesia. But, we really do need to look hard before we let them leap. The consequences of taking rash action can be just as bad doing nothing. The consequences of letting them get away with it again (S&L, anyone?) and sticking the common taxpayer with the bill is really unacceptable to me. The executives will not likely have their unearned takings taken away. They'll probably be punished with more tax breaks.  ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: debrewguy

Date Posted: September 24 2008 at 20:21

DB - the point is that if you're big enough, you get bailed out time & again. Yet, there was no emergency when the actual home buyers, borrowers, were defaulting on mortgages that no financial expert can defend as being "credit-worthy. Where was the bail-out plan for them ? Oh, they were individuals. Not corporations. And as this situation seems to happen every 10-20 years (S & L, Long Term Hedge Fund et al), is it possible that bail-outs don't work. Could it be that the government does better by applying socialist policies towards the citizenship rather than the miilionaires ? Bush had Congress tighten bankruptcy laws at the Credit Card companies behest, because it was felt that it was too easy for people to get away with not paying their debts. Where is that logic now ? And finally - the cliche investment concept - take on higher risk in return for the possibility of a higher gain. If there is no real risk, why the higher return > And if there was really no profit, why wouldn't the resulting dividends, bonuses and other subsequent rewards be taken back. If it is said to be a very complex undertaking, well, hey, here's $700 billion they're ready to spend covering up the mistakes. It's time to say enough. The top 5% income brackets do not need financial subsidies. Indeed, you could even argue that the top third aren't really needy when it comes to money. So why do they get the biggest breaks ? Universal Health Care is too expensive. Care to calculate how many years of basic universal health care $700 billion might cover ? Would you believe that this is a better investment in America, than saving Bankers' skin? Wouldn't you know that this could actually contribute more to productivity and economic superiority than corporate welfare schemes that protect MBA Ponzi artists from their themselves ? Bu, no, that socialism. Giving to the poor, to those who aren't in the higher income brackets is bad for business. It is time to say enough. The same old same old didn't work before, and it won't work any better now. So why have the american taxpayer repeatedly keep footing the bill for business' greed ? WHY ?????? ------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: Slartibartfast

Date Posted: September 24 2008 at 20:43

Maybe we need to take up a bake sale for all these poor corporate executives?  You know what? They need to fail so maybe they can learn a little responsibility. Is their failure going to savage the economy? Their misdeeds already have... ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: jammun

Date Posted: September 24 2008 at 21:10

|

What was the name of Metallica's first album? |

Posted By: BroSpence

Date Posted: September 25 2008 at 01:25

Great post, sir. In my letters to various congressmen the other day, I mentioned how irresponsible it would be if hand over $700 dollars to people that didn't want anything to do with the government until they had themselves a dirty diaper. However, the diaper was dirty before, just not completely full of s***. I'd certainly invest that money if it was given to me. OR maybe I could just go get a bunch of credit cards and use them on some ridiculous purchases and see if the government will hand me a big check. Bush and Bernanke sure like using scare tactics to get this bailout in motion. I haven't seen anyone else talk about it though. No one from congress has even mentioned possible other plans except to get some small protections included to the already recommended one. |

Posted By: laplace

Date Posted: September 25 2008 at 02:13

|

pick a hundred of the most visible complicit people and have them burned at the stake. between this and the farcical election run-up, the onlooker concludes that the US way of living is insane and unsustainable and its morals shallow ------------- FREEDOM OF SPEECH GO TO HELL |

Posted By: Henry Plainview

Date Posted: September 25 2008 at 02:51

It is necessary, unless you libertarian people want another Great Depression.

Did I just read that? Please tell me I didn't just read that correctly.

But what good is $10,000 if you have nothing to spend it on? I don't think you people understand the magnitude of all our banks collapsing when you so cavalierly say NO MORE MONEY FOR RICH PEOPLE!

http://www.forbes.com/home/2008/09/23/bailout-paulson-congress-biz-beltway-cx_jz_bw_0923bailout.html - But that doesn't mean I think they're doing a good job, that quote from the spokesperson is unbelievable. ------------- if you own a sodastream i hate you |

Posted By: The Doctor

Date Posted: September 25 2008 at 03:10

NO MORE MONEY FOR RICH PEOPLE!

Seriously, I think the first thing the government should do is seize all of the assets of the directors and managers of the banks and use that money as part of the bailout. No, it probably won't amount to $700 billion or enough to save the banks, but maybe the people who run banks in the future will be a bit more responsible with the way they run them, if they know they will be held personally liable for failure. Why should everyone else be responsible for bailing out the banks and not those who had a direct hand in the banks' failures. ------------- I can understand your anger at me, but what did the horse I rode in on ever do to you? |

Posted By: The Doctor

Date Posted: September 25 2008 at 05:19

|

This from the Daily Mash: Lehman chief executive Dick Fuld said: "Be in no doubt, the long term effects of this collapse are going to be awful. For you. "You're going to lose your job, your dignity and possibly your home. I don't need a job - per se - but I will miss accumulating more money than I and all my descendants could ever reasonably spend. "I don't know what I'd do if I hadn't spent my career paying myself millions of dollars and accruing a vast personal fortune while taking pointless risks with people's hard earned savings. "But I hope my unimaginable wealth and wide ranging property portfolio will make your extreme hardship that bit easier to bear."Would you be happier if I sat out the recession in Acapulco or Martha's Vineyard? Please do let me know." ------------- I can understand your anger at me, but what did the horse I rode in on ever do to you? |

Posted By: BaldFriede

Date Posted: September 25 2008 at 06:17

|

I say "Let them banks rot"! They take all the profits when playing hazard at the stock market without giving any of the money back to the community but want the state, which of course means the community, to take the risk. No way! One should not fear an economy crisis; there is no such thing as long as there is an abundance of goods around. Now when the means of production all broke down for some reason, that would be a crisis! But money can't be eaten; it is just an easy way of evaluating goods. -------------  BaldJean and I; I am the one in blue. |

Posted By: BaldFriede

Date Posted: September 25 2008 at 06:30

So what? These "experts" know which side their toast is buttered on. "Whose bread I eat, whose song I sing", as a German proverb says. No, there will be no real harm done if these banks collapse, even if a lot of firms collapse in their wake. The means of production are still there; they only have to be given to someone else. They are the real wealth, not stocks and money. -------------  BaldJean and I; I am the one in blue. |

Posted By: IVNORD

Date Posted: September 25 2008 at 08:43

|

Posted By: IVNORD

Date Posted: September 25 2008 at 08:50

|

Posted By: IVNORD

Date Posted: September 25 2008 at 08:53

|

Posted By: IVNORD

Date Posted: September 25 2008 at 08:59

Bailout. It will be worse without it if people start losing jobs in a chain reaction from WS bankers down to waiters and security guards.

|

Posted By: IVNORD

Date Posted: September 25 2008 at 09:08

|

Posted By: IVNORD

Date Posted: September 25 2008 at 09:15

|

Posted By: Atkingani

Date Posted: September 25 2008 at 09:56

|

We should have learned the lesson in 1630:

http://en.wikipedia.org/wiki/Tulip_mania - http://en.wikipedia.org/wiki/Tulip_mania

But greed dominates and periodically crisis like that have occured and will continue to.... ------------- Guigo ~~~~~~ |

Posted By: BaldFriede

Date Posted: September 25 2008 at 11:07

The stock market is a pseudo-economy in the first place. The original idea of stocks was to give those who offered stocks a financial basis for operations. But today the stock market has lost connection with that idea completely; stocks have become a value for themselves. No matter how important servicing is, the most important thing is still the production of goods. You can't live on services at all. And the means of production are there unless a natural catastrophe destroys them. The means of servicing, in essence manpower, are also there; they will not disappear just because a few firms go bankrupt. There will, however, have to be a reassessment of values, which is long overdue in the first place anyway. -------------  BaldJean and I; I am the one in blue. |

Posted By: Padraic

Date Posted: September 25 2008 at 14:40

How do you think the Great Depression happened in this country? |

Posted By: Henry Plainview

Date Posted: September 25 2008 at 14:43

I stopped reading here because you clearly have absolutely no idea what you are talking about. ------------- if you own a sodastream i hate you |

Posted By: crimhead

Date Posted: September 25 2008 at 14:57

Some people are already predicting that this election won't be decided til January. What fun times again if that happens. Burning at the streak is too good for them. Make them live and work in the inner cities away from their palaces and see how they like living like the vast majority does. |

Posted By: Henry Plainview

Date Posted: September 25 2008 at 15:07

Last I heard, the vast majority of people do not live in inner cities... ------------- if you own a sodastream i hate you |

Posted By: Garion81

Date Posted: September 25 2008 at 15:09

EXACTLY

The banks are responsible by lending to people who should not have received loans and the people who borrowed against an inflated wealth in their house are responsible as well. People who signed for loans that they had no business borrowing are also just as responsible. This isn't just a bunch of big bankers this about millions of people losing their houses and jobs. Millions of people who took no part in this are going to suffer. Then to extend it a little further the banks doesn't have the money to lend to business who borrow all the time to keep their cash flow goings for such trivial things as your next paycheck. The bailout would remove the bad loans to allow the banks to continue to keep lending. It is that serious. We are facing a far flung recession that we may not recover from for several decades. This would plunge the world into it as well. Please at least research what this about before posting about it. -------------

"What are you going to do when that damn thing rusts?" |

Posted By: Syzygy

Date Posted: September 25 2008 at 16:47

|

The credit crunch came about because banks loaned money to people who couldn’t pay it back. That’s right, the upstanding guardians of our finances, the people we entrust with our savings and pensions, the people into whose system most of our paychecks are fed directly every month, effectively walked into a bookmaker’s with all our money and lost it betting on a 3 legged donkey. Then governments use taxpayer’s money – our money – to bail them out. There was really no need to throw that money away in the first place. The banks were profitable and operating in a time of remarkable prosperity and security, so the only real motive for behaving so irresponsibly was the temptation of a fast profit. Or, to put it another way, uncontrolled greed. And what of the irresponsible borrowers? Vast hordes of the financially disadvantaged did not storm the City brandishing pitchforks and flaming torches, demanding unlimited credit. No, highly paid experts dreamed up a range of financial products and services aimed specifically at that sector of the market, and then spent huge amounts money aggressively targeting them. People who previously could never have got near a mortgage were actively encouraged to borrow way above their ability to pay back if there was even a minor financial hiccup solely so they could get a toe onto the bottom rung of the property ladder. Then the whole house of cards collapsed. ‘You can’t interfere with the market’ suddenly gave way to ‘Bail us out! Now!’.Just as a bad workman blames his tools, so does a bad business blame its customers.

The banking system was totally complicit in all of this, and then either didn't see the crisis forming or ignored it in the hope that it would go away, and the same is true of the first MBA qualified president and a government who proclaimed 'It's the economy, stupid!'

Of course something needs to be done, but there should be consequences. First Enron and now this - to say nothing of numerous other crises - surely prove that unfettered free market capitalism is as ludicrous and redundant a concept as Soviet socialism.

(not originally written for PA) ------------- 'Like so many of you I've got my doubts about how much to contribute to the already rich among us...' Robert Wyatt, Gloria Gloom |

Posted By: IVNORD

Date Posted: September 25 2008 at 17:35

As for service vs manufacturing/ agriculture/ science, the means of production became so technologically advanced that modern production of goods requires very few workers to sustain high levels of output to provide for the entire population. THe remaining work force, freed from production, is employed in services. On top of that, using your beloved Marxist terminology, the division of labor in the global economy is not what it used to be when Marx wrote about it. Today it spans the globe. Labor intensive industries are transferred to low labor cost markets. Thus a service economy can exist

|

Posted By: IVNORD

Date Posted: September 25 2008 at 18:02

From what I hear, a couple of years ago to get a mortgage one had just to appear at the bank's door. No credit check, no income check, no downpayment. It's like you're walking down the street and someone gives you a nice chunk of money. Would you refuse?

The banks were in a similar situation. The Fed flooded them with funds. If they just kept the money in their vaults, what good would it do? Besides, nobody asked them what they were doing with it and how they checked the prospective applicants.

So who's responsible? Here comes the Federal Reserve Bank.

|

Posted By: debrewguy

Date Posted: September 25 2008 at 19:23

The Fed was selling ABCPs ? That is how the banks were able to "justify" financing the mortgages. They were bundled and sold as securities, investments, to other financial institutions around the world. I really wish I knew why you think the Fed is a conspiratorial entity ????????? The reality from the S & L debacle is that those who profited kept their money, and the American Taxpayer paid. And that experience was so enlightening and effective at preventing other such events. Soooooooooooooooooo, if that bailout didn't do much, why not just give the money to the American people, and let them spend as they see fit. Whether it's investing, buying or saving or paying down debt. Let's face it, the money will go through the system , eh. ------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: IVNORD

Date Posted: September 26 2008 at 08:11

Yea, they bundled the mortgages and sold them as MBS's, but where did the money come from? In a "proper" economy it should come from savings. In our case the capital was provided by the Fed in the form of extra liquidity supposedly to stimulate the economy. Just look at the money supply charts for the past 40-50 years.

|

Posted By: IVNORD

Date Posted: September 26 2008 at 08:18

|

Posted By: debrewguy

Date Posted: September 26 2008 at 12:39

|

Wonder why Republicans conservatives aren't just writing the blank cheque that Bush has asked ? Is it that the thought of regulations being required has thrown them off balance ? Anyway, Bush will argue that you can't put too many restrictions so as not to impede the free market, while intruding in the free market to save those who were its' most prominent boosters. you're right IV, let's give it up, and hand it over as meekly and unquestioning as the S & L bucket brigade did. ------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: IVNORD

Date Posted: September 26 2008 at 16:34

|

Posted By: debrewguy

Date Posted: September 26 2008 at 23:01

|

As quoted from the CBC's (Canadian Broadcasting Corporation) Washington correspondant Henry Champ sept 26 column (URL - http://www.cbc.ca/news/reportsfromabroad/champblog/2008/09/measuring_mccain_the_distracti.html) "Let's look at the timeline that led McCain to Washington. It starts Wednesday at 8 a.m., when Republican Sen. Tom Coburn of Oklahoma calls Barack Obama and suggests that Obama and McCain put out a joint statement supporting the congressional effort since so many of the positions the two candidates have on this issue are the same. Coburn and Obama have worked together before. Coburn says this could be helpful. Obama agrees. He phones McCain with the idea. McCain says: Not a bad idea, let me get back to you. In the meantime, McCain phones the White House. He suggests that Bush call a summit of congressional leaders, as well as Obama and McCain, to add support to the legislative effort. Oh, and allow me, Mr. President, to make the suggestion public. It could help my image, one presumes he suggests. Bush agrees. McCain then calls Obama, six hours after Obama's morning call and agrees to a joint statement. Within minutes, McCain has called a press conference, suspended his campaign, tried to delay the debate, announced a White House summit. In Florida, Obama is floored. Senior Democrats are furious as well. Banking committee chairman Chris Dodd calls this effort an "unwarranted three-hour distraction." Bailout plan will succeedThursday, McCain arrives in Washington but never joins the deliberations. Senate majority leader Harry Reid asks for, but never receives, a statement on where McCain wants to go on the issues. Reid later says: "I have asked John McCain where he stands and the only stand I've seen is when McCain is in front of a microphone." Reporters ask the principals how often over the last days McCain been in contact with them. "Never" and "seldom" are the answers. McCain does meet with dissident House Republicans, but neither supports or rejects their position. What those Republicans do figure out, though, is that cover has arrived. They go to the White House and say they will vote no on any package. This package is dead, they tell the media. Earlier, we mentioned sausage-making. There is no chance this bailout package will be ditched. But its final form is yet to be determined. Now it's Friday afternoon. Guess what? The debate is back on. Press conferences are indicating that progress is being made. Recently, polls have steadily showed Obama inching ahead and the issue propelling him is the economy. That fact may have unsettled McCain, caused him to give in to his known risk-taking side. He did get a photo at the White House. He did make a difference in the process. It was a negative one." As far as giving up, the point was to say " let's just hand over the money again and again until they learn their lesson; 'cause we sure don't seem to learn ours!" Add to this, that Bush seems insistent that taking any time to think things out will cause more damage than good. IF my government is going to throw $700 billion (estimates are that it will eventually come in at a trillion) at a problem not of its' making, then they better take the time and do it right. Haste makes waste, and IV, you said that governments have a tendency to do so. And Bush saying that he doesn't believe that regulations should be to strict so as not to impede the free market ... well, as the Republican Conservatives are telling him - free markets mean winners and losers. The losers shouldn't be entitled to bailouts because of greed and bad planning. If the free market needs government bailouts and subsidies, then the government is well withing its' rights to impose regulations to hopefully avoid the same thing happening again. Self regulation didn't work in the S & L scandal, it didn't do a damn thing to stop the Long Term Mgmt hedge fund from blowing up, and the financial and investment industry proved once more this time that they have no clue how to so. Let's try something new. ------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: npjnpj

Date Posted: September 27 2008 at 07:05

|

Let's not crap around, it's very simple:

1) You as a customer give me (I'm the bank) a dollar for safekeeping.

2) I gamble and loose it.

3) I get another dollar from you via the tax you pay.

4) I use that dollar to pay you back, and we're all square.

Gimme a break! All that bullsh*t talk is not going to camouflage what's going on, luckily, the people seem to be upset enough to see what's going on, for once.

|

Posted By: IVNORD

Date Posted: September 27 2008 at 13:05

Saddest Thing About This Mess: Congress Had Chance To Stop ItBY TERRY JONES INVESTOR'S BUSINESS DAILY

http://www.investors.com/editorial/IBDArticles.asp?artsec=16&artnum=1&issue=20080926 - http://www.investors.com/editorial/IBDArticles.asp?artsec=16&artnum=1&issue=20080926

Could the crisis at Fannie Mae ( javascript:jsfOpenPowerTool%28H3Q4Q5,1,0%29 - FNM ) - Freddie Mac ( javascript:jsfOpenPowerTool%28H3U4I5,1,0%29 - FRE ) and the subprime meltdown have been avoided? The answer is yes. As early as 1992, alarm bells were going off on the threat Fannie and Freddie posed to our financial system and our economy. Intervention at any point could have staved off today's crisis. But Democrats in Congress stood in the way. As the president recently said, Democrats have been "resisting any efforts by Republicans in the Congress or by me . . . to put some standards and tighten up a little on Fannie Mae and Freddie Mac." No, it wasn't President Bush who said that; it was President Clinton, Democrat, speaking just last week. Interesting, because it was his administration's relentless focus on multiculturalism that led to looser lending standards and regulatory pressure on banks to make mortgage loans to shaky borrowers. Freddie and Fannie, backed by an "implicit" taxpayer guarantee, bought hundreds of billions of dollars of those subprime loans. The mortgage giants, whose executive suites were top-heavy with former Democratic officials (and some Republicans), worked with Wall Street to repackage the bad loans and sell them to investors. As the housing market continued to fall in 2007, subprime loan portfolios suffered major losses. The crisis was on — though it was 15 years in the making. Democrats Blocked Reform Just as Republicans got blamed for Enron, WorldCom and other early-2000s scandals that were actually due to the anything-goes Clinton era, the media are now blaming them for the mortgage meltdown. But Republicans tried repeatedly to bring fiscal sanity to Fannie and Freddie. Democrats opposed them, especially Sen. Chris Dodd and Rep. Barney Frank, who now run Congress' key banking panels. History is utterly clear on this. After Treasury Secretary Lawrence Summers warned Congress in 1999 of the "systemic risk" posed by Fannie and Freddie, Congress held hearings the next year. But nothing was done. Why? Fannie and Freddie had donated millions to key congressmen and radical groups, ensuring no meaningful changes would take place. "We manage our political risk with the same intensity that we manage our credit and interest rate risks," Fannie CEO Franklin Raines, a former Clinton official and current Barack Obama adviser, bragged to investors in 1999. In November 2000, Clinton's HUD hailed "new regulations to provide $2.4 trillion in mortgages for affordable housing for 28.1 million families." It made Fannie and Freddie take part in the biggest federal expansion of housing aid ever. Soon after taking office, Bush had his hands full with the Clinton recession and 9/11. But by 2003, he proposed what the New York Times called "the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago." The plan included a new regulator for Fannie and Freddie, one that could boost capital mandates and look at how they managed risk. Even after regulators in 2003 uncovered a scheme by Fannie and Freddie executives to overstate earnings by $10.6 billion to boost bonuses, Democrats killed reform. "Fannie Mae and Freddie Mac are not facing any kind of financial crisis," said Rep. Frank, then-ranking Democrat on the Financial Services Committee. North Carolina Democrat Melvin Watt accused the White House of "weakening the bargaining power of poorer families and their ability to get affordable housing." In 2005, then-Fed Chairman Alan Greenspan told Congress: "We are placing the total financial system of the future at substantial risk." McCain Urged Changes That year, Sen. John McCain, one of three sponsors of a Fannie-Freddie reform bill, said: "If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system and the economy as a whole." Sen. Harry Reid — now Majority Leader — accused the GOP of trying to "cripple the ability of Fannie Mae and Freddie Mac to carry out their mission of expanding homeownership." The bill went nowhere. This year, the media have repeated Democrats' talking points about this being a "Republican" disaster. Well, McCain has repeatedly called for reforming the mortgage giants. The White House has repeatedly warned Congress. This year alone, Bush urged reform 17 times. Some GOP members are complicit. But Fannie and Freddie were created by Democrats, regulated by Democrats, largely run by Democrats and protected by Democrats. That's why taxpayers are now being asked for $700 billion. |

Posted By: crimhead

Date Posted: September 27 2008 at 18:48

|

Posted By: JJLehto

Date Posted: September 27 2008 at 23:20

|

It WOULD be a good idea.....

but the government will f*ck it up.

Either accidentaly or on purpose (^ looking at crimhead's post)

Every week I see something else that pisses me off more

I want Socialism!!!!!

|

Posted By: Slartibartfast

Date Posted: September 28 2008 at 07:55

So can you tell me why exactly when the Republicans had control of the house and senate and then the house, senate, and the presidency (not to mention the supreme court) they didn't bother to take action to correct this? Lord knows they rammed through plenty of crap that wasn't good for this country. Oh, I get it, they were too busy pushing through crap that wasn't good for the country to attend to this matter.  When you point the finger you just may have three pointing back at you. ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: debrewguy

Date Posted: September 28 2008 at 12:21

IS it a good guess on my part Slartibartfast, that you didn't have to Google-cheat to know this info ? Unlike some people here (myself included  ) )------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: IVNORD

Date Posted: September 29 2008 at 00:03

And since I have no ideological preferences (unlike you) I can expand on the subject a bit more. If the Republicans were the patriots they claim they are, they would have stood up to this crap and put an end to this orgy long ago. But being the hypocritical pigs they are they could not stop this feast (which action would be immensely unpopular) for the fear of being voted out of office for the next few centuries. So they went along. After all it was good for bisiness, big business that is, who they are big supporters of, the fact they have the guts to admit sometimes. On the other hand the Democrats being the hypoctitical swine they are possess all nice qualities of the Republicans plus they have the temerity to claim they care about the common man.

|

Posted By: BroSpence

Date Posted: September 29 2008 at 02:38

| So the "new" proposal has been released. Sounds like they took the same plan and split it into segments and supposedly added protections to it, for us? Still has to be passed though. And I guess its quite true. We have absolutely no say where our money is going. |

Posted By: npjnpj

Date Posted: September 29 2008 at 04:01

|

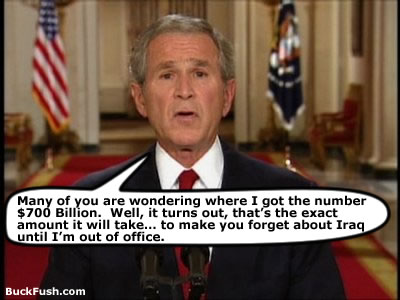

Secureties, protection, segregated payments?

It's just double-talk, the same lot of bull, unchanged since last week, camouflaged ever so slightly to fool people into thinking there's a bit more substance to it.

I like the way George W. is using the age old weapon of scare tactics to get the public convinced that this is the only way to go. Old, but apparently still very effective. Smooth!

|

Posted By: Slartibartfast

Date Posted: September 29 2008 at 07:38

|

This is interesting: > "How to Bail Out Wall St. at No Cost to the TaxpayersThom Hartmann wrote an interesting piece on how to bail out Wall St. without costing the taxpayers a dime. The idea is to create a new government agency to manage the bailout. The treasury would then loan it money to bail out Wall St. firms that are in trouble. The government would then institute a http://www.commondreams.org/view/2008/09/26 - Securities Turnover Excise Tax of 0.25% on stock trades with revenues going to the new agency. For long-term investors who buy stock in companies they believe in and keep it for years adding a quarter of 1% to the cost hardly matters, and even to speculators it is not huge. It is estimated that such a tax would generate at least $150 billion a year, so the $700 billion load would be paid off in 5 years. The US has had such a tax in the past and used it to finance the Civil War, Spanish-American War, WWI and WWII. Many other countries have a similar tax. This proposal is clearly a viable alternative to either giving Wall St. $700 billion as a freebie or even getting stock in return for the money. Wall St. managers might even prefer it to a plan that limited their future compensation. Mother Jones lists yet five more http://www.motherjones.com/mojoblog/archives/2008/09/9955_five_alternative_different_bailout_plans.html - alternative bailout plans ." The Votemaster But the president's on TV right now. They've apparently come to an agreement on the bailout. That can only mean one thing. We're going to get screwed again. |

Posted By: npjnpj

Date Posted: September 29 2008 at 08:02

|

Since the great unveiling of the rescue plan yesterday, has anyone seen the presidential candidates clamouring for the glory?

It seems that they're not too keen to be associated with this package, strange really, as both of them seemed very eager to be hailed as saviours of the economy last week.

__________________________________

Apart from that: Why is everybody acting as if pumping 700 billion into the system will make the whole thing go away? The general opinion is that the banking crisis is far from over, we're possibly in the middle stage with other banking and insurance institutions' collapse still to follow. And what then?

|

Posted By: Tapfret

Date Posted: September 29 2008 at 12:19

|

Its simply just another Bush era corporate welfare program. The difference is, Bush is leaving office so he won't need to fork out another "economic stimulus check" to each taxpayer to make them forget about the previous round of corporate welfare programs. The American people have bent over and took it for this administration, and this is just one more shot for the road.

------------- https://www.last.fm/user/Tapfret" rel="nofollow">  https://bandcamp.com/tapfret" rel="nofollow - Bandcamp |

Posted By: Padraic

Date Posted: September 29 2008 at 14:41

| http://money.cnn.com/2008/09/29/news/economy/bailout/index.htm?eref=rss_topstories - House rejects the bill. |

Posted By: Slartibartfast

Date Posted: September 29 2008 at 15:18

| Thank God. This enormous chunk of change is not something that should be rushed through. And the options that spare the taxpayers the burden are really needing serious consideratio. |

Posted By: Padraic

Date Posted: September 29 2008 at 15:24

Agreed. Still think something must be done, but this bill wasn't it. |

Posted By: Eddy

Date Posted: September 29 2008 at 17:03

| f**k the bailout.... it will go to the fatcats and theyll be sipping on a martini in athe bahamas while were suffer a major depression........ How many of you guys know that this is a ll part of the new world order??? Fuk the neocons and the democrats both parties are corrupt. obamas forin policy is almost the same as mcains its all a big lie guys.... |

Posted By: Slartibartfast

Date Posted: September 29 2008 at 17:23

I just noticed I misspelled consideration. Is consideratio anything like fellatio?  It is refreshing that politicians on both sides of the spectrum united to put a smack down on this.     September 29, 2008

Jonathan Schwarz:

http://thismodernworld.com/4491 - -->Abraham

Lincoln Speaks Out On Public Money And Banks

This is Abraham Lincoln, then an Illinois state representative, speaking in the legislature http://quod.lib.umich.edu/cgi/t/text/text-idx?c=lincoln;cc=lincoln;type=simple;rgn=div1;q1=fleece;singlegenre=All;view=text;subview=detail;sort=occur;idno=lincoln1;node=lincoln1%3A92 - on January 11, 1837 . He’s referring to a dispute between private shareholders of the Illinois State Bank:

Lincoln’s speech was given just as one of the greatest speculative bubbles in US history was bursting. This was followed by the http://en.wikipedia.org/wiki/Panic_of_1837 - Panic of 1837 , which led to a six-year contraction described by Milton Friedman as “the only depression on record comparable in severity and scope to the Great Depression.” http://thismodernworld.com/category/uncategorized/ - Uncategorized | --> posted by http://tinyrevolution.com/mt/ - Jonathan Schwarz at 8:26 AM http://thismodernworld.com/4491 - |

link ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: BroSpence

Date Posted: September 30 2008 at 02:51

Yes the admin does love to tell people the sky is falling every time it wants something. I also love the new "developing story" of everyone shoving the blame around as to why the bill didn't pass. It was a poor bill, fear is in the heart of wall st. hence the big point drop, and Congress sucks. I found this commentary quite interesting: http://www.cnn.com/2008/POLITICS/09/29/miron.bailout/index.html - Another different look on the situation. |

Posted By: npjnpj

Date Posted: September 30 2008 at 04:13

| I find that article to possibly be the most sensible and level-headed thing I've read about the crisis in a long time. |

Posted By: Slartibartfast

Date Posted: September 30 2008 at 06:59

Good article. Still I can't help but wonder how many of those who got the crappy subprime loans might not have defaulted if they had been given decent fixed rate loans. ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: Padraic

Date Posted: September 30 2008 at 10:31

My understanding is that it was adjustable-rate loans with ridiculously low intro "teaser" rates that allowed most people to get into a house - fixed rate stuff would have been at too high an interest rate for them to afford it. Of course, either they didn't understand what they were getting into, or were duped, but either way when the rate skyrocketed after the teaser period they were obviously screwed. |

Posted By: BaldFriede

Date Posted: September 30 2008 at 11:01

Nothing will happen. Will the cars for transport break? Will the people involved in the service die? It is all still there; the only thing that has to happen is that our values have to change a bit, or rather quite drastically. But better an end with terror than a terror without end. It is simply ridiculous how overrated the well-being of economy has become; everything else has to subordinate to it. It is high time someone blows the whistle on it, and it is a good thing we have this eye-opener now. To quote Peter Hammill: "When we built up the temple of the money Gods we opened up Pandora's box". -------------  BaldJean and I; I am the one in blue. |

Posted By: Atkingani

Date Posted: September 30 2008 at 12:26

|

Apparently the issue that Capitalism does better is to produce Panic:

http://en.wikipedia.org/wiki/Category:Economic_disasters_in_the_United_States - http://en.wikipedia.org/wiki/Category:Economic_disasters_in_the_United_States

Seeing the amount of 'panics' in the Mecca of Capitalism one can reasonably multiply per 10 when other countries are considered. ------------- Guigo ~~~~~~ |

Posted By: Slartibartfast

Date Posted: September 30 2008 at 12:43

Did someone say PANIC?        ------------- Released date are often when it it impacted you but recorded dates are when it really happened...

|

Posted By: BaldFriede

Date Posted: September 30 2008 at 13:34

Very nice remark, Atkingani And has any of these "collapses" ever really changed anything basically? Yes, there were a few financial breakdowns, but the country could continue as it did before in the end. And why? Because all the resources were still there. Now a natural catastrophe, that would be something completely different. But an economical one merely means possessions will change. If money was not that overrated in the world but reduced to what it was originally meant to be, a means for evaluation of goods, this would be no problem at all. I don't deny the bank crash will have a deep impact. But only on the surface. If it weren't for those people who "sit" on the money instead of having it recirculate, as would be necessary for a functioning economy, this could not have happened at all. But the accumulation of money that does not get back into the economy circuit is the real problem, not a bank crash. That's only the symptom. -------------  BaldJean and I; I am the one in blue. |

Posted By: debrewguy

Date Posted: September 30 2008 at 13:36

|

Economists all agree on a bailout ? Most economists agree on need for a bailout ? would most economists be putting in their own money ? Don't many economists work for the financial industry, the beneficiary of said bailout ? Would that be called a conflict of interest ? Could we verify the "track record" of economists in predicting recessions (I believe the joke is that they've predicted 11 out of the last 5  ) ? If economists are so prescient, how many saw this coming, and why weren't their warnings heeded ? Is it possible that the bailout might make a negligible difference in the actual "pain" that Joe Average will suffer, i.e. there is still going to be a recession, or economic retraction because of credit being harder to get ? Will Bush mention this ? Does he understand this ? ) ? If economists are so prescient, how many saw this coming, and why weren't their warnings heeded ? Is it possible that the bailout might make a negligible difference in the actual "pain" that Joe Average will suffer, i.e. there is still going to be a recession, or economic retraction because of credit being harder to get ? Will Bush mention this ? Does he understand this ?------------- "Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case. |

Posted By: Vibrationbaby

Date Posted: September 30 2008 at 13:37

|

YEE HAA ! We`re all going to hell in a hand basket.

------------- |

Posted By: Padraic

Date Posted: September 30 2008 at 13:39

|

Posted By: Henry Plainview

Date Posted: September 30 2008 at 13:55

lol, crazy internet people. Well it seems that not passing the bailout was a good idea. 777 points, yeah! ------------- if you own a sodastream i hate you |

Finnforest wrote:

Finnforest wrote: