/PAlogo_v2.gif)

/PAlogo_v2.gif) |

|

Post Reply

|

Page <1 230231232233234 294> |

| Author | |||||

Equality 7-2521

Forum Senior Member

Joined: August 11 2005 Location: Philly Status: Offline Points: 15784 |

Posted: August 07 2013 at 06:47 Posted: August 07 2013 at 06:47 |

||||

|

It appears as though it was 3.27% of the GDP from a quick google search. I recall it being closer to 5% though. I might have to look into the data a bit later. But let's say 3.27% for now.

|

|||||

|

"One had to be a Newton to notice that the moon is falling, when everyone sees that it doesn't fall. "

|

|||||

|

|||||

rogerthat

Prog Reviewer

Joined: September 03 2006 Location: . Status: Offline Points: 9869 |

Posted: August 07 2013 at 06:57 Posted: August 07 2013 at 06:57 |

||||

|

As against, what, nearly 10% at the end of George W Bush's term? Combined with debt that matches or surpassed the GDP. idk, I think the magnitude of the 2008 crisis has generally been underestimated. China has tried a Keynesian binge since 2008 and it seems their economy will slow down in spite of it.

|

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 07 2013 at 10:29 Posted: August 07 2013 at 10:29 |

||||

I'm actually not sure. I know Pat is right the debt did soar under Hoover, how "massive" was it compared to previous history I'm not sure, can check later.

That is indeed the maxim but the blog I posted actually disagrees, arguing that government surpluses are a bad thing, since it must be balanced by the private sector deficit spending. Again it's just an intriguing idea you never hear about (and the mainstream Keynesians actually ridicule it) but it's worth a look into. At least for the pursuit of all ideas out there, much as I pursued Austrian thought.

Bush was indeed very different, in that both private and public ran deficits...this was still balanced though by the orgy of cheap imports we consumed. Check it: http://neweconomicperspectives.org/wp-content/uploads/2012/03/untitled-32.png It's confusing but basically private, public and foreign balances all = 0

What is the background and workings of this complex relationship and what does it "mean" is not touched upon and it's way beyond me to guess. IMHO the 2000s economy was just weak. A boom for the FIRE economy but us on the street had a tough time of it, and that pretty much explains my family who never quite made it back from the 2001 recession, and progressively struggled through the "boom" before the crash.

It may be why we spent like mad yet there were gov deficits, they weren't collecting as much tax revenue and many got worse off.

This could relate to Austrian thought IMO. That perhaps the Fed policies created the dreaded bubble economy.

The progressives put the blame on de regulation and the market, I can see validity but I also think it's wrong to ignore the mentality and impacts created by Greenspan. Edited by JJLehto - August 07 2013 at 10:31 |

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 07 2013 at 10:39 Posted: August 07 2013 at 10:39 |

||||

Gah wish I had more time at work to fiddle around but off the top of my head, this link was one of my favorites. Debt as % of GDP

This is both public and private debt, and I think that's critical as we all tend to look at just government debt. Look at those f**king huge spikes, that's not all government...even for the Bush years and the 20s had decreasing gov debt.

It's the accumulation of private debt that seems to be the problem, again the debate can be what exactly causes such excess.

You hit on a point I made yesterday, this is unique. You are right, the gravity of it all may not has even hit us fully yet! We lived through an epic, global economic bubble, perhaps like we've never seen and all the $$ pumping, and stimulii and etc may just have been band aids, and the recovery is still a long long way off.

|

|||||

|

|||||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32588 |

Posted: August 07 2013 at 13:36 Posted: August 07 2013 at 13:36 |

||||

|

http://news.yahoo.com/congress-wins-relief-obamacare-health-plan-subsidies-173241340.html

Edited by Epignosis - August 07 2013 at 13:36 |

|||||

|

|||||

rogerthat

Prog Reviewer

Joined: September 03 2006 Location: . Status: Offline Points: 9869 |

Posted: August 07 2013 at 20:24 Posted: August 07 2013 at 20:24 |

||||

Those are pretty scary numbers. Yeah, the last para exactly sums it up. The 20s boom wasn't so global because all the advances in transport and communication that have made the world inter dependent were yet to happen. From the 90s onwards - with only a three-four year pause in Asia after 1998 - there was a sustained, steady economic boom. And its steadiness caused the 'experts' to believe that all the 'fundamentals' were in place. But it was just the biggest bubble of possibly all times. Govts are struggling to wean the public off 'growth', to do so would be political suicide for them. Besides, it's the banks that need austerity (when, far from it, they got bailed out) and govts seem to have no clue how to impose that. Cutting public expenditure will improve the position in the short term but if the recovery thereafter is not quick, it could seriously dampen the economic climate and cause more damage. |

|||||

|

|||||

rogerthat

Prog Reviewer

Joined: September 03 2006 Location: . Status: Offline Points: 9869 |

Posted: August 07 2013 at 20:39 Posted: August 07 2013 at 20:39 |

||||

Exactly, so why should private+govt+external always add up to zero is not clear to me yet. Need to read more on this to understand the logic. But I am surprised that Keynesians would ridicule this because when I learnt economics in undergraduate college, the chapter on Keynes had this equation too. So it's vaguely familiar to me but I can't recall the logic given for it at the time.

Looking at the data, they absolutely created a bubble. I remember we would read data about US consumer spending year after year at that time and the figures were staggering, vis a vis the low rate of growth. A low interest rate regime combined with a de regulated financial sector and a President who urges people to take loans to buy homes as he will stand guarantee are all perfect conditions for a consumer bubble. There were predictions of a recession in 2002 but Greenspan headed it off with his easy money policy. Speaking of which... Bernanke hiked the rates steeply once he took office and that precipitated the crash. Since then, he has kept rates really low, waiting for some employment threshold before he can start tightening. Who's to say his successor won't again get going with the tightening in full steam and trigger the next crisis. And it's then we'll learn if any of these stress tests done on banks would help at all.

|

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 08 2013 at 07:26 Posted: August 08 2013 at 07:26 |

||||

|

It's not that which seems to be ridiculed, but their claim that: it's fine to always run a deficit, we never want to run a surplus. Which I'm not sure about to be honest. They are right almost all our history have been deficits and perhaps running a surplus isn't recommended, but deficits have generally been small before the 1980s. When they say it's fine to always run deficits many may not disagree but how large is the question I have. I may actually email some of them and just ask!

It does seem that way! And I think the mentality of the bubble is important, while the left blames greedy bankers, de regulation, the insane attitude wall street took etc I think it's all a by product. As the good times never ended and we managed to "smoothen" the cycle for 20 years it's like we all got drunk. Especially with a Greenspan Fed that seemed dedicated to keeping asset prices up and there have been various government bailouts of wall street shenanigans. Why not get super greedy and take such short run, make every penny possible, de fraud all attitude?

That is the fear, our recovery is just the next bubble and eventually it'll pop, or Fed will raise rates, and we're right back to recession. Though it seems we havn't built a bubble (I think?) it's just been stagnation. IDK man, seems rough to let it "bottom" out but maybe that's what we did need. Instead of holding the boat up just so it can eventually sink anyway. I'm sure the banks are as screwed as ever

|

|||||

|

|||||

Equality 7-2521

Forum Senior Member

Joined: August 11 2005 Location: Philly Status: Offline Points: 15784 |

Posted: August 08 2013 at 09:35 Posted: August 08 2013 at 09:35 |

||||

|

"One had to be a Newton to notice that the moon is falling, when everyone sees that it doesn't fall. "

|

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 08 2013 at 12:40 Posted: August 08 2013 at 12:40 |

||||

|

|||||

|

|||||

rogerthat

Prog Reviewer

Joined: September 03 2006 Location: . Status: Offline Points: 9869 |

Posted: August 08 2013 at 23:58 Posted: August 08 2013 at 23:58 |

||||

If that is their claim, I am inclined to disagree. But I am open to revisit that stand if empirical evidence demonstrates why it is ok to always run a deficit. But even by that mathematical equation, if private sector was buried in a debt mountain and imports far exceeded exports, wouldn't govt need to step in with a surplus. In other words, austerity.

Exactly, there's got to be some threshold even if we assume it is alright to run govt on deficit. Plus, a public deficit essentially means govt crowding out the private sector. That can and has led to high inflation before.

It is contagious. In any group endeavour, it is important for the top to set the example that they want the bottom pile to follow. When you have the president goading the bottom pile to just go and borrow money from Fannie and get a flat without worrying about the consequences, it sends frugality for a toss.

Well, I am not a big believer in economic 'cleansing'. The fact is, whenever there is a boom again in the future, people will again allow themselves irrational exuberance and make mistakes. So it is more of a cynical than structural problem. Austerity in these times can serve to deflate optimism too much if it persists for too long. What should have been done is instead of having banks estimate how much money they need (what a brilliant idea!!!!) they should have only been capitalised for their near term survival and any auto majors that were about to fail should have been allowed to. Ford did turn it around all by themselves and it's pretty unfair to babysit GM at taxpayer expense. Anybody who made mistakes in the marketplace should have had to pay for it while the govt should have stepped in to spend money on those decades old bridges that apparently badly need to be replaced. They would have had money to spare for it and it would have created some employment to keep the economy chugging, instead of wasting money on bailouts for companies which is, er, a pretty socialist thing to do. Infrastructure is generally not a bad place for the govt to step in because some projects may not be attractive in the short run for businesses to take up but they would eventually serve the local community well and, in turn, the overall economy. Speaking of which, I am not a big believer in things like minimum wages or unemployment benefits. It might sound surprising to those in this thread who may have taken me to be a leftie, but I don't believe in free lunches. It's money down the drain and it makes the beneficiaries lazy and complacent at the end of the day. The govt should give you all the support you need to make ends meet, like medicine or education for your kids...if you are prepared to take up a job and work hard. That is non negotiable in my mind.

|

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 09 2013 at 12:05 Posted: August 09 2013 at 12:05 |

||||

|

Yeah I can't say I'm a fan of "austerity" I dont have a ton of data from what I do know it seems to be a poor idea during a depressed economy.

That is their claim btw and to make it more out there, while deficits are "good" and a surplus must mean reduction of private wealth they also claim too big a gov deficit can indeed be inflationary. It's all pretty out there and I was confused so I just emailed one of the blog writers, right to their college email. Surprisingly he responded and was open to answer my questions.

Here's what L Randall Wray of U of Missouri-Kansas City said about how big a deficit is too big:

You cannot say ex ante what size of deficit will be inflationary; depends on the other 2 sectors.

The JG/ELR helps to keep the deficit at the right size, but again impossible to say what that is.

The JG being the "job guarantee" or "employer of last resort" which is their policy that the government should guarantee a job, at minimum wage, for anyone who wants one.

Their claim being jobs are more important than welfare, also less "free ride" and deficits would thus be a natural counter cycle. As opposed to the very silly idea IMO that Congress will actually raise taxes/cut spending in boom, lower/raise in a bust. Always seemed non sensical to me.

Anywho, I asked what about other welfare with this job guarantee in place:

You will need a quite small welfare system after you put in place the JG, although you will need SocSec for the aged.

What about taxes then?

Taxes drive the currency; they can be used to reduce AggD as necessary. And you can use them to reduce the richness of the rich. You also can tax "bads".

What role does trade play then in this 3 balance thing?

International trade is overrated. Both negatively and positively.

So at least Prof Wray takes a kind of "market" view that it will "sort it itself out".

He didn't give me an answer to how big a deficit is too big, that it can't be known and that's a bit worrying...

But yeah, guess in their ideal world most of welfare will be replaced with a JG, which along with the whims of private spending and trade being what it is, it all will work out. I guess. It's quite theoretical, I'd like to see a place try this in full scale! Edited by JJLehto - August 09 2013 at 12:09 |

|||||

|

|||||

rogerthat

Prog Reviewer

Joined: September 03 2006 Location: . Status: Offline Points: 9869 |

Posted: August 09 2013 at 12:12 Posted: August 09 2013 at 12:12 |

||||

|

Ok, I do agree that it is impossible to say at what point a govt deficit would lead to high inflation but that is also why encouraging public deficits is not such a great idea. Even with economic pundits telling them all the time that they shouldn't let the budget deficit soar, they do. Imagine what would happen if there was theoretical support for deficit spending.

I do agree that the size of the welfare system should be small anyhow, with or without a job guarantee.  As for international trade, perhaps it is not so important in USA as dollar is the world currency for all practical purposes. But I couldn't say for sure with other countries. A depreciating currency makes imports costlier and drives up inflation so it has a very real impact on the economy. We are experiencing that right now so I tend to disagree that international trade is overrated.

|

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 09 2013 at 12:15 Posted: August 09 2013 at 12:15 |

||||

|

I do agree, infrastructure is a good place for (however you want it done) public spending. At the very least it's useful, our infrastructure is a disaster. |

|||||

|

|||||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: August 09 2013 at 12:17 Posted: August 09 2013 at 12:17 |

||||

Worth a look though, as I think any idea is worth a look.

Edited by JJLehto - August 09 2013 at 12:17 |

|||||

|

|||||

dtguitarfan

Forum Senior Member

Joined: June 24 2011 Location: Chattanooga, TN Status: Offline Points: 1708 |

Posted: August 10 2013 at 08:00 Posted: August 10 2013 at 08:00 |

||||

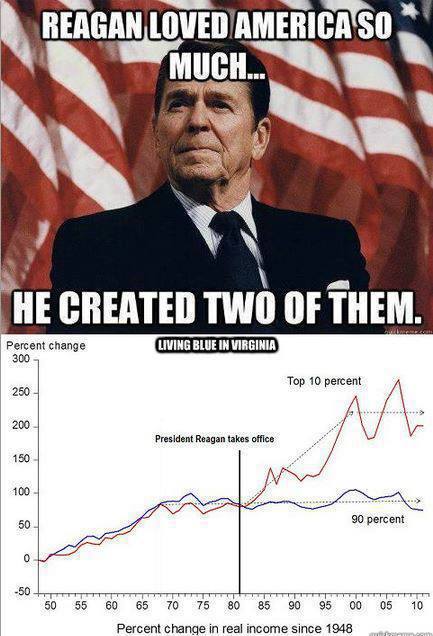

This guy said: "Government is not the solution to our problem, government is the problem." And then he made sure he was right about it. And Republicans have been creating the problems they say they're here to fix ever since.... Edited by dtguitarfan - August 10 2013 at 08:00 |

|||||

|

|||||

Equality 7-2521

Forum Senior Member

Joined: August 11 2005 Location: Philly Status: Offline Points: 15784 |

Posted: August 10 2013 at 08:00 Posted: August 10 2013 at 08:00 |

||||

|

Your point?

|

|||||

|

"One had to be a Newton to notice that the moon is falling, when everyone sees that it doesn't fall. "

|

|||||

|

|||||

dtguitarfan

Forum Senior Member

Joined: June 24 2011 Location: Chattanooga, TN Status: Offline Points: 1708 |

Posted: August 10 2013 at 08:05 Posted: August 10 2013 at 08:05 |

||||

I just think it's interesting that now Libertarians are trying to sell us the same line. Guy comes along and breaks the country in two after getting us all mad at government, and ever since that, one party has been making our government worse and worse while saying "government IS the problem, government IS the problem!", and now Libertarians want to come along and completely get rid of government. Seems to me the real problems could be fixed by bringing things back to the way they were before Reagan..... Actually, the number 1 problem in our country is corporate money in politics. I think that's the absolute first thing we should get rid of and then other problems will naturally start to fix themselves. But you guys will never ever listen. Your ideology doesn't allow you to consider facts or ideas. I really didn't want to get back into a discussion. Just came in here to drop and bomb and leave again. Buh bye. |

|||||

|

|||||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32588 |

Posted: August 10 2013 at 08:16 Posted: August 10 2013 at 08:16 |

||||

Well, you certainly bombed. |

|||||

|

|||||

The T

Special Collaborator

Honorary Collaborator Joined: October 16 2006 Location: FL, USA Status: Offline Points: 17493 |

Posted: August 10 2013 at 11:10 Posted: August 10 2013 at 11:10 |

||||

|

I don't like corporate money in politics either.

I don't like money in politics period. I don't like politics. I don't like money either. But it would be difficult to survive without the latter.

|

|||||

|

|||||

|

|||||

Post Reply

|

Page <1 230231232233234 294> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |