| Author |

Topic Search Topic Search  Topic Options Topic Options

|

Dean

Special Collaborator

Retired Admin and Amateur Layabout

Joined: May 13 2007

Location: Europe

Status: Offline

Points: 37575

|

Posted: March 07 2013 at 08:13 Posted: March 07 2013 at 08:13 |

Gerinski wrote: Gerinski wrote:

In a 're-insurance scheme' on the other hand, the re-insurer will carefully judge the risk it is taking, and will not allow excessive risks being taken by the insured party. It provides a more self-regulating mechanism. |

I'm no expert but isn't this how banks work anyway - unlike the simplistic view presented in Frank Capra's It's A Wonderful Life, no bank has deposited funds equal to the loans they give out - they loan out more money than they hold in deposits. This is exactly what you are proposing - spreading the risks (ie loans) to other banks - they borrow the money they lend, the repayments on the first loan funds their repayments on their subsequent loans, all they have to ensure is their interest rates to the customer are higher than the interest rates they get charged. This is why the LIBOR rates are so important to the banks, this is why toxic assets are so bad for them.

Banks function because money moves, if money stops moving they simply cannot operate because they don't hold sufficient fixed deposits to pay their loans. Bank 'A' lends the money to customer 'B' and then borrows the same mount from bank 'C', 'B' uses the loan to buy from 'D', 'D' deposits that money with bank 'A', 'C', or even 'E' - within the system of 'A', 'C' and 'E' there is now a sufficient deposit to cover the loan. All the need to do is ensure that 'A' funds that movement of money by charging 'A' interest on the loan so that 'B', 'C', 'D' and 'E' can all make money.

|

|

What?

|

|

Gerinski

Prog Reviewer

Joined: February 10 2010

Location: Barcelona Spain

Status: Offline

Points: 5154

|

Posted: March 07 2013 at 10:46 Posted: March 07 2013 at 10:46 |

Dean wrote: Dean wrote:

This is exactly what you are proposing - spreading the risks (ie loans) to other banks

|

No, there's a big difference, a loan needs to be paid back, an insurance does not (sure you need to pay the premium but not the amount of the eventual damage). What I'm saying is that banks should be compulsorily insured against the risks they take.

|

|

Jim Garten

Special Collaborator

Retired Admin & Razor Guru

Joined: February 02 2004

Location: South England

Status: Offline

Points: 14693

|

Posted: March 07 2013 at 11:17 Posted: March 07 2013 at 11:17 |

You won't - I think the standard form of payment is a bag containing 30 pieces of silver.

|

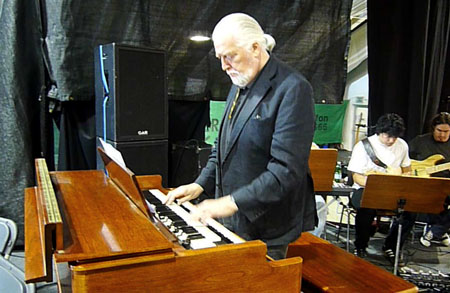

Jon Lord 1941 - 2012

|

|

Dean

Special Collaborator

Retired Admin and Amateur Layabout

Joined: May 13 2007

Location: Europe

Status: Offline

Points: 37575

|

Posted: March 07 2013 at 11:43 Posted: March 07 2013 at 11:43 |

Gerinski wrote: Gerinski wrote:

Dean wrote: Dean wrote:

This is exactly what you are proposing - spreading the risks (ie loans) to other banks

|

No, there's a big difference, a loan needs to be paid back, an insurance does not (sure you need to pay the premium but not the amount of the eventual damage). What I'm saying is that banks should be compulsorily insured against the risks they take. |

I think we are talking in circles here, because that's what the FDIC, FSCS and all those other "insurance" schemes are currently doing. The bank can always foreclose on a bad loan, it cannot magic-up a lost deposit. Since protecting the loan has the same net effect as protecting the deposit then it doesn't matter which you pay the insurance premium on - however, from the insurers perspective the deposits are a lower risk so the premiums for the banks will be lower.

|

|

What?

|

|

Gerinski

Prog Reviewer

Joined: February 10 2010

Location: Barcelona Spain

Status: Offline

Points: 5154

|

Posted: March 07 2013 at 14:08 Posted: March 07 2013 at 14:08 |

I'm not an expert either, but I don't think we're talking in circles that much. With re-insurance, an insurance company faced with an in principle bankrupt threat such as a major disaster affecting most of its insured customers can survive without needing support from the government, from my money, or without screwing its customers. This is not the case with banks, when they screw it they screw it and regardless of such schemes, they often take along their customers with them (for example the protection scheme in Belgium covers only up to 100.000 euro, any further amounts are not insured and you just loose them), and then it's nice for them having the government backup with the motivation that 'they are too big to let them fail'. Banks have needed our money to be rescued from the excessive risks they took, that is a fact, therefore I don't see it the same as the re-insurance case, as far as I know not one of my euro-cents has been used to rescue insurance companies.

|

|

rogerthat

Prog Reviewer

Joined: September 03 2006

Location: .

Status: Offline

Points: 9869

|

Posted: March 07 2013 at 19:10 Posted: March 07 2013 at 19:10 |

|

^^ In short, are you arguing for a way to re-insure the deposits of customers of a failed bank? A good idea, there should be some recourse for a customer to claim his lost deposit. It is the fear of losing deposits that triggers bank runs and, eventually, a financial crisis. Banks routinely write off loans on which they have no further scope of recovering money because they've gone bad. It's the risk they undertake, like any other entrepreneurial activity. It is also a heavily regulated industry and there are norms on what percentage of your assets can be NPAs, your reserves and how they are maintained. The problem is in the 2008 crisis banks were saddled with loans that had been identified as good but were really NPAs.

If you've watched the documentary Inside Job, even economists managed violent conflict of interest at that time, receiving huge sums of money from the chamber of commerce of countries on which they would write favourable opinions. If the integrity of regulatory and academic institutions is compromised so seriously, there is no hope of averting a future crisis....we can only hope the next one is at least a decade away.

|

|

Dean

Special Collaborator

Retired Admin and Amateur Layabout

Joined: May 13 2007

Location: Europe

Status: Offline

Points: 37575

|

Posted: March 08 2013 at 02:18 Posted: March 08 2013 at 02:18 |

Gerinski wrote: Gerinski wrote:

I'm not an expert either, but I don't think we're talking in circles that much. With re-insurance, an insurance company faced with an in principle bankrupt threat such as a major disaster affecting most of its insured customers can survive without needing support from the government, from my money, or without screwing its customers.

This is not the case with banks, when they screw it they screw it and regardless of such schemes, they often take along their customers with them (for example the protection scheme in Belgium covers only up to 100.000 euro, any further amounts are not insured and you just loose them), and then it's nice for them having the government backup with the motivation that 'they are too big to let them fail'.

Banks have needed our money to be rescued from the excessive risks they took, that is a fact, therefore I don't see it the same as the re-insurance case, as far as I know not one of my euro-cents has been used to rescue insurance companies.

|

I absolutely agree with everything you have said. BUT they will not adopt your re-insurance idea while the existing methods are in place because it costs money.

Insurance companies are not saved or bailed-out, their assets and liabilities are transfered to other insurance companies, all the consumer sees is a change in the name on letterhead. Insurance companies are not squeaky clean - anyone with a private pension, life insurance or endowment policy on their mortgage will know they are just as capable of taking stupid risks with other peoples money

|

|

What?

|

|

Donate monthly and keep PA fast-loading and ad-free forever.

/PAlogo_v2.gif)