Progarchives.com has always (since 2002) relied on banners ads to cover web hosting fees and all.

Please consider supporting us by giving monthly PayPal donations and help keep PA fast-loading and ad-free forever.

/PAlogo_v2.gif) |

|

Post Reply

|

Page <1 1415161718 269> |

| Author | |||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: June 29 2010 at 02:25 Posted: June 29 2010 at 02:25 |

||

|

I don't know how exactly...but I still like the idea of some sort of "trickle up" economics.

All this talk of consumption reminded me of that. Seems like a good way to boost the economy to me! More to come tomorrow. I am finally going to sleep. Totally unrelated note: A part time job just came in, hopefully I can get a full time one soon. The money will be useful and welcome. The moment I get a check I'll be sure to b*tch to yall about the taxes they deduct from me   |

|||

|

|||

Dean

Special Collaborator

Retired Admin and Amateur Layabout Joined: May 13 2007 Location: Europe Status: Offline Points: 37575 |

Posted: June 29 2010 at 02:31 Posted: June 29 2010 at 02:31 |

||

|

^ as long as you remember that the tax money was never yours in the first place and that in the 10 minutes you spend goofing off in each hour you are working for the government you'll be fine

|

|||

|

What?

|

|||

|

|||

StyLaZyn

Forum Senior Member

Joined: November 22 2005 Location: United States Status: Offline Points: 4079 |

Posted: June 29 2010 at 05:30 Posted: June 29 2010 at 05:30 |

||

Otherwise, let them not be able to afford survival and die off? How Ebeneezer Scrooge of you.  |

|||

|

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: June 29 2010 at 06:04 Posted: June 29 2010 at 06:04 |

||

It bears remembering that Ford lowered the cost of his cars so that the people who made them could be able to afford to buy them. Quite clever if you ask me. These days the costs of goods and services are often run up so that people at the top of the ladder can take in more money. Ford remained fairly wealthy. CEO's and other elites these days are obscenely wealthy and it's not a good thing... It also should be noted that at this country's height of prosperity, the wealthy were heavily taxed... The revenues built up our infrastructure, which helped in the prosperity of the country. Taxes have been slashed on the rich and our infrastructure is crumbling along with our prosperity. The "supreme" court has further entrenched corporate person-hood. Care to explain to me how this will advance our country? Edited by Slartibartfast - June 29 2010 at 06:17 |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 07:03 Posted: June 29 2010 at 07:03 |

||

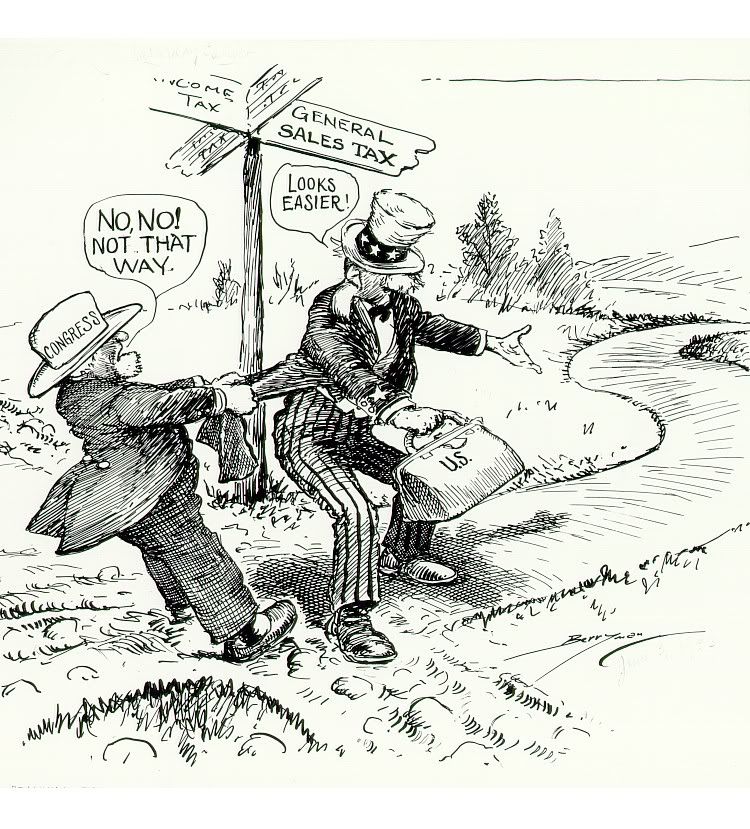

Just "tax," not income tax.  Tourists are taxed by consumption taxes anyway (except the state and local governments get the money). |

|||

|

|||

horsewithteeth11

Prog Reviewer

Joined: January 09 2008 Location: Kentucky Status: Offline Points: 24598 |

Posted: June 29 2010 at 11:27 Posted: June 29 2010 at 11:27 |

||

But liberals claim that it helps the poor! Oh wait.... (From Wikipedia) Opponents of the minimum wage claim it has these effects: -As a labor market analogue of political-economic protectionism, it excludes low cost competitors from labor markets, hampers firms in reducing wage costs during trade downturns, generates various industrial-economic inefficiencies as well as unemployment, poverty, and price rises, and generally dysfunctions.[28] -Hurts small business more than large business.[29] -Reduces quantity demanded of workers, either through a reduction in the number of hours worked by individuals, or through a reduction in the number of jobs.[30][31] -May cause price inflation as businesses try to compensate by raising the prices of the goods being sold.[32][33] -Benefits some workers at the expense of the poorest and least productive.[34] -Can result in the exclusion of certain groups from the labour force.[35] -Businesses may spend less on training their employees.[36] -Is less effective than other methods (e.g. the Earned Income Tax Credit) at reducing poverty, and is more damaging to businesses than those other methods.[36] -Discourages further education among the poor by enticing people to enter the job market.[36] Seems that according to opponents of minimum wage (like myself), it actually hurts the poor, not helps them. |

|||

|

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: June 29 2010 at 11:46 Posted: June 29 2010 at 11:46 |

||

|

With regard to the minimum wage, the better you pay the people at the bottom, the more money they have to spend on basic goods and services. I'd like a minimum wage opponent to seriously explain how this is bad for the economy. It bears repeating that the US economy was at it's best when we were taxing the hell out of the rich and using the revenues for the public good. A consumption tax is just a Trojan horse to further reduce the taxes on the wealthy and transfer the burden to rest of us. Just ask yourself how much extra are you willing to pay for your goods and services so the people at the top can get yet another tax break?

Some may say this is just class envy. Actually more like common sense. I have no illusion that I will join the ranks of the super rich. I wasn't born into the right family and given the same privileges. Edited by Slartibartfast - June 29 2010 at 11:49 |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 12:18 Posted: June 29 2010 at 12:18 |

||

It's quite simple. When the government forces companies to pay employees more, the companies raise the prices of their goods and services. So "the people at the bottom" have more money, sure, but then the cost of living increases. And some companies opt to lay off workers here and outsource. This article manofmystery linked to goes into detail about why governmental interference like raising the minimum wage will only drive the economy toward failure: http://mises.org/freemarket_detail.aspx?control=499

Source? |

|||

|

|||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: June 29 2010 at 13:13 Posted: June 29 2010 at 13:13 |

||

|

It's like I said, we're debating on very different ideological bases. Much as I enjoy it, none of us are gunna make much head way in here.

I'm not saying f*ck it all and go crazy, like we've done for a long time....but sometimes I do think $ needs to eschewed and do whats right, even if it may not be "best" way. As for consumption tax, my final words echo that sentiment. I know you Rob don't like it for this reason, but it is really another way to let the wealthy escape. The Fair Tax Act was put forward by a group created by Businessmen...to me that already casts a shadow on the motives behind it, and it has been pushed in Congress by John Linder, who represents a very wealthy district in GA. And I've had people tell me before "Im racist against the rich" for real, or "Marxism" "Class Warfare" all that. I just think the middle class needs some salvation, no matter what taxes do overall...tax rates always seem to increase for us. Even the Bush Tax cuts saw overall tax rate for the middle class edge up a bit. As for the affluent/business I don't hate them or want to punish them. When I say progressive tax people have asked "why do I want to punish success?" Theres the problem. If you see it that way then fine. I see it as a duty. If you make more $ you should pay more in taxes. I guess I believed in the social contract before I even knew what it was. And Rob has already said, (at least I hope you were sincere) that he saw I really DONT want government to run buiness....I am not a socialist. I really dont know the best answer, but it's out there. At least for me... |

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 13:38 Posted: June 29 2010 at 13:38 |

||

You cannot judge a proposal's merit because of its advocates. Who else is going to put forth comprehensive changes in the way the government obtains revenue? The cable guy?

I would even prefer a flat tax over the current system. Doesn't our current system violate the principle of equality before the law? From the article linked there: "[The current system] presumes that the property rights of the wealthy are not as sacred as the property rights of the poor and that the values of the majority are superior to the rights of the minority. " I like my music progressive...not my taxes.  |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: June 29 2010 at 13:39 Posted: June 29 2010 at 13:39 |

||

I'll post a reference when I get home. Remind me if I don't. I assure you I am not making this up. |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: June 29 2010 at 18:25 Posted: June 29 2010 at 18:25 |

||

Hey man I'm being 100% honest here, not trying to BS you, we all have biases right? Like I said, you like the idea based on ideology...but the fact it was put forward by businessmen....I dont think ideology (limited government all that good stuff) was their motives. Like I said, Im fully admitting my biases here, if I could go in depth with it/hear alternatives and end up liking it, that'd be cool. BUT for right now the fact a group of businessmen came up with the idea, well I dont much care for it  And speaking of bias...the Cato Institute. I will put my bias aside, and read it without judgement, or I'll try. Though it does bring up a good point, everyone going crazy about Obama's taxes...he said they would be restored to what they were under Clinton, which was 39.6%. As that article said, it was above 90% at one point. And even if Obama did nothing, the Bush tax cuts were going to end in 2011 anyway, and it would've happened regardless Edited by JJLehto - June 29 2010 at 18:29 |

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 18:48 Posted: June 29 2010 at 18:48 |

||

|

To be honest with you JJ, I "thought of" the "Fair tax" before I'd even heard of it. It was several years ago when I was thinking about sales tax and how some states do not have a state income tax, and I, while speaking with my (future) father-in-law about it, wondered, "Why can't the federal government replace the income tax with a consumption tax?" No forms, you could reduce the IRS significantly (thereby saving money), and it's harder to evade. Since then, it's only made more and more sense to me.

The current, overly complex tax code really makes it easier for businesses to lobby for tax shelters and protect convoluted loopholes. I fail to see how a consumption tax would benefit wealthy business owners more than the current system does. |

|||

|

|||

StyLaZyn

Forum Senior Member

Joined: November 22 2005 Location: United States Status: Offline Points: 4079 |

Posted: June 29 2010 at 18:58 Posted: June 29 2010 at 18:58 |

||

If you mean flat tax, that would be a good idea. |

|||

|

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 19:14 Posted: June 29 2010 at 19:14 |

||

I would support either, really. |

|||

|

|||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: June 29 2010 at 19:15 Posted: June 29 2010 at 19:15 |

||

|

Im guessing you're not the only one Rob, I've noticed every idea I ever thought of (and Im talking politics, music, anything) has always been done already....pisses me off sometimes. In fact, (thank god for wiki!) Apparently the Church of Scientology came up with the idea of a National Sales Tax in 1990. Wonder if the fair tax guys read that and adopted it... And this is from 1933  We've already talk about it man, no need to beat the dead horse...but remember the ideological bases we are each standing on: Freedom v. Redistribution (dont like the word but cant think of a better, simple single word to describe my base  ) )You are right. There I said it! It is the easiest alternative presently. And yes, it is perhaps the most fair. You spend big, you're taxed big, simple. But, as I said lower income goes, less freedom you have to do so, (in regards to saving). Sure, people will buy yachts, ferrari's whatever but many will live frugally as well. Again, this is not an issue to yeah since it's their choice to do so, but I just don't like the idea of being able to do so. And it's not just lower income man. I dont know what my family would qualify as, middle or upper middle. But where we live, most of our family income goes to consumption and I dont mean luxury. Sure, we have fun, we can do things, but a lot of it goes to living. (The outrageous property tax doesn't help). Especially with the recession, we've taken no vacations, not spent much at all on enjoyment. And let's say you live in NYC. Fuhgetaboudit! Eh Im rambling...not everyone can afford to save as easily as higher earners, who have more $ so dont need more tax freedom. And things like income equality probably doesnt matter to you, but to me it does and it has been increasing since Reagan. Keep chipping away, and I try to keep my mind open but it is my belief system which is pretty rooted by now. Gunna be hard to change fundamentally what I believe, and same with you. So I am calling a ceasefire, or unilateral pull out, whichever. Random thought: Rob how do you feel about gay marriage? Let each state decide, or its completely wrong and should be illegal. Edited by JJLehto - June 29 2010 at 19:22 |

|||

|

|||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: June 29 2010 at 20:46 Posted: June 29 2010 at 20:46 |

||

|

Other random note...

Anyone hear about the Supreme Court case that was just ruled? The right to bear arms can not be infringed upon by State or Local government. So the city of Chicago, for example, can not pass any gun control laws? Or any city or state? Doesn't seem too Federalist/Libertarian to me, but I assume the response will be that it is specifically mentioned in the 2nd amendment and thus any person can bear arms, and not state or even local government can infringe upon it. Ah well, I'm sure politicians will some find way around it. They always do dont they? |

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 21:25 Posted: June 29 2010 at 21:25 |

||

As you say, it's an ideological thing. You think tax freedom is based on need, and I do not. I hope you change your mind, but if you don't, I respect your right to vote your conscience.

I am opposed to gay marriage. I believe marriage is between one man and one woman (and for life). |

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: June 29 2010 at 21:30 Posted: June 29 2010 at 21:30 |

||

damn pesky Constitution wait, you think a decision saying the government can't take away your guns isn't very Libertarian? lol Edited by Padraic - June 29 2010 at 21:31 |

|||

|

|||

Epignosis

Special Collaborator

Honorary Collaborator Joined: December 30 2007 Location: Raeford, NC Status: Offline Points: 32524 |

Posted: June 29 2010 at 21:38 Posted: June 29 2010 at 21:38 |

||

That's not really the ruling. There's still assault weapon bans, and felons can't buy firearms in most if not all states. The issue here was with a handgun ban, the likes of which the Supreme Court had already struck down years before in a federal jurisdiction (Washington DC). |

|||

|

|||

Post Reply

|

Page <1 1415161718 269> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |