/PAlogo_v2.gif) |

|

Post Reply

|

Page <1 34567 11> |

| Author | |||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 07:38 Posted: September 29 2008 at 07:38 |

||

|

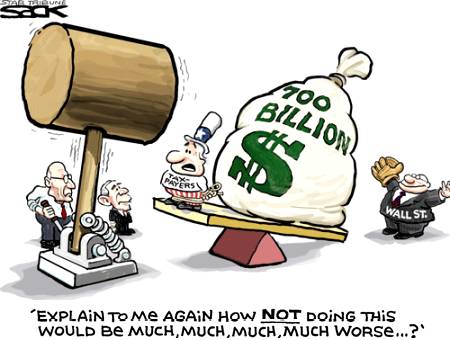

This is interesting:

> "How to Bail Out Wall St. at No Cost to the TaxpayersThom Hartmann wrote an interesting piece on how to bail out Wall St. without costing the taxpayers a dime. The idea is to create a new government agency to manage the bailout. The treasury would then loan it money to bail out Wall St. firms that are in trouble. The government would then institute a Securities Turnover Excise Tax of 0.25% on stock trades with revenues going to the new agency. For long-term investors who buy stock in companies they believe in and keep it for years adding a quarter of 1% to the cost hardly matters, and even to speculators it is not huge. It is estimated that such a tax would generate at least $150 billion a year, so the $700 billion load would be paid off in 5 years. The US has had such a tax in the past and used it to finance the Civil War, Spanish-American War, WWI and WWII. Many other countries have a similar tax. This proposal is clearly a viable alternative to either giving Wall St. $700 billion as a freebie or even getting stock in return for the money. Wall St. managers might even prefer it to a plan that limited their future compensation. Mother Jones lists yet five more alternative bailout plans." The Votemaster But the president's on TV right now. They've apparently come to an agreement on the bailout. That can only mean one thing. We're going to get screwed again. Edited by Slartibartfast - September 29 2008 at 23:18 |

|||

|

|||

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 29 2008 at 08:02 Posted: September 29 2008 at 08:02 |

||

|

Since the great unveiling of the rescue plan yesterday, has anyone seen the presidential candidates clamouring for the glory?

It seems that they're not too keen to be associated with this package, strange really, as both of them seemed very eager to be hailed as saviours of the economy last week.

__________________________________

Apart from that: Why is everybody acting as if pumping 700 billion into the system will make the whole thing go away? The general opinion is that the banking crisis is far from over, we're possibly in the middle stage with other banking and insurance institutions' collapse still to follow. And what then? Edited by npjnpj - September 29 2008 at 08:17 |

|||

|

|||

Tapfret

Special Collaborator

Honorary Collaborator / Retired Admin Joined: August 12 2007 Location: Bryant, Wa Status: Offline Points: 8581 |

Posted: September 29 2008 at 12:19 Posted: September 29 2008 at 12:19 |

||

|

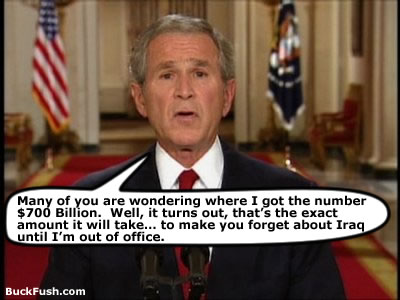

Its simply just another Bush era corporate welfare program. The difference is, Bush is leaving office so he won't need to fork out another "economic stimulus check" to each taxpayer to make them forget about the previous round of corporate welfare programs. The American people have bent over and took it for this administration, and this is just one more shot for the road.

|

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 29 2008 at 14:41 Posted: September 29 2008 at 14:41 |

||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 15:18 Posted: September 29 2008 at 15:18 |

||

|

Thank God. This enormous chunk of change is not something that should be rushed through. And the options that spare the taxpayers the burden are really needing serious consideratio.

Edited by Slartibartfast - September 29 2008 at 23:18 |

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 29 2008 at 15:24 Posted: September 29 2008 at 15:24 |

||

Agreed. Still think something must be done, but this bill wasn't it. |

|||

|

|||

Eddy

Forum Senior Member

Joined: September 22 2004 Location: USA Status: Offline Points: 637 |

Posted: September 29 2008 at 17:03 Posted: September 29 2008 at 17:03 |

||

|

f**k the bailout.... it will go to the fatcats and theyll be sipping on a martini in athe bahamas while were suffer a major depression........ How many of you guys know that this is a ll part of the new world order??? Fuk the neocons and the democrats both parties are corrupt. obamas forin policy is almost the same as mcains its all a big lie guys....

|

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 17:23 Posted: September 29 2008 at 17:23 |

||

I just noticed I misspelled consideration. Is consideratio anything like fellatio?  It is refreshing that politicians on both sides of the spectrum united to put a smack down on this.     September 29, 2008

Jonathan Schwarz:

This is Abraham Lincoln, then an Illinois state representative, speaking in the legislature on January 11, 1837. He’s referring to a dispute between private shareholders of the Illinois State Bank:

Lincoln’s speech was given just as one of the greatest speculative bubbles in US history was bursting. This was followed by the Panic of 1837, which led to a six-year contraction described by Milton Friedman as “the only depression on record comparable in severity and scope to the Great Depression.” Uncategorized | --> posted by Jonathan Schwarz at 8:26 AM |

link Edited by Slartibartfast - September 29 2008 at 21:20 |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

BroSpence

Forum Senior Member

Joined: March 05 2007 Status: Offline Points: 2614 |

Posted: September 30 2008 at 02:51 Posted: September 30 2008 at 02:51 |

||

Yes the admin does love to tell people the sky is falling every time it wants something. I also love the new "developing story" of everyone shoving the blame around as to why the bill didn't pass. It was a poor bill, fear is in the heart of wall st. hence the big point drop, and Congress sucks. I found this commentary quite interesting: Another different look on the situation. |

|||

|

|||

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 30 2008 at 04:13 Posted: September 30 2008 at 04:13 |

||

|

I find that article to possibly be the most sensible and level-headed thing I've read about the crisis in a long time.

|

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 30 2008 at 06:59 Posted: September 30 2008 at 06:59 |

||

Good article. Still I can't help but wonder how many of those who got the crappy subprime loans might not have defaulted if they had been given decent fixed rate loans. |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 30 2008 at 10:31 Posted: September 30 2008 at 10:31 |

||

My understanding is that it was adjustable-rate loans with ridiculously low intro "teaser" rates that allowed most people to get into a house - fixed rate stuff would have been at too high an interest rate for them to afford it. Of course, either they didn't understand what they were getting into, or were duped, but either way when the rate skyrocketed after the teaser period they were obviously screwed. |

|||

|

|||

BaldFriede

Prog Reviewer

Joined: June 02 2005 Location: Germany Status: Offline Points: 10261 |

Posted: September 30 2008 at 11:01 Posted: September 30 2008 at 11:01 |

||

Nothing will happen. Will the cars for transport break? Will the people involved in the service die? It is all still there; the only thing that has to happen is that our values have to change a bit, or rather quite drastically. But better an end with terror than a terror without end. It is simply ridiculous how overrated the well-being of economy has become; everything else has to subordinate to it. It is high time someone blows the whistle on it, and it is a good thing we have this eye-opener now. To quote Peter Hammill: "When we built up the temple of the money Gods we opened up Pandora's box". |

|||

BaldJean and I; I am the one in blue. |

|||

|

|||

Atkingani

Special Collaborator

Honorary Collaborator / Retired Admin Joined: October 21 2005 Location: Terra Brasilis Status: Offline Points: 12288 |

Posted: September 30 2008 at 12:26 Posted: September 30 2008 at 12:26 |

||

|

Apparently the issue that Capitalism does better is to produce Panic:

Seeing the amount of 'panics' in the Mecca of Capitalism one can reasonably multiply per 10 when other countries are considered.

|

|||

|

Guigo

~~~~~~ |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 30 2008 at 12:43 Posted: September 30 2008 at 12:43 |

||

|

Did someone say PANIC?

|

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

BaldFriede

Prog Reviewer

Joined: June 02 2005 Location: Germany Status: Offline Points: 10261 |

Posted: September 30 2008 at 13:34 Posted: September 30 2008 at 13:34 |

||

Very nice remark, Atkingani And has any of these "collapses" ever really changed anything basically? Yes, there were a few financial breakdowns, but the country could continue as it did before in the end. And why? Because all the resources were still there. Now a natural catastrophe, that would be something completely different. But an economical one merely means possessions will change. If money was not that overrated in the world but reduced to what it was originally meant to be, a means for evaluation of goods, this would be no problem at all. I don't deny the bank crash will have a deep impact. But only on the surface. If it weren't for those people who "sit" on the money instead of having it recirculate, as would be necessary for a functioning economy, this could not have happened at all. But the accumulation of money that does not get back into the economy circuit is the real problem, not a bank crash. That's only the symptom. |

|||

BaldJean and I; I am the one in blue. |

|||

|

|||

debrewguy

Special Collaborator

Honorary Collaborator Joined: April 30 2007 Location: Canada Status: Offline Points: 3596 |

Posted: September 30 2008 at 13:36 Posted: September 30 2008 at 13:36 |

||

|

Economists all agree on a bailout ? Most economists agree on need for a bailout ? would most economists be putting in their own money ?

Don't many economists work for the financial industry, the beneficiary of said bailout ? Would that be called a conflict of interest ? Could we verify the "track record" of economists in predicting recessions (I believe the joke is that they've predicted 11 out of the last 5  ) ? If economists are so prescient, how many saw this coming, and why weren't their warnings heeded ? Is it possible that the bailout might make a negligible difference in the actual "pain" that Joe Average will suffer, i.e. there is still going to be a recession, or economic retraction because of credit being harder to get ? Will Bush mention this ? Does he understand this ? ) ? If economists are so prescient, how many saw this coming, and why weren't their warnings heeded ? Is it possible that the bailout might make a negligible difference in the actual "pain" that Joe Average will suffer, i.e. there is still going to be a recession, or economic retraction because of credit being harder to get ? Will Bush mention this ? Does he understand this ? |

|||

|

"Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case.

|

|||

|

|||

Vibrationbaby

Forum Senior Member

Joined: February 13 2004 Status: Offline Points: 6898 |

Posted: September 30 2008 at 13:37 Posted: September 30 2008 at 13:37 |

||

|

YEE HAA ! We`re all going to hell in a hand basket.

Edited by Vibrationbaby - September 30 2008 at 13:38 |

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 30 2008 at 13:39 Posted: September 30 2008 at 13:39 |

||

|

|||

|

|||

Henry Plainview

Forum Senior Member

Joined: May 26 2008 Location: Declined Status: Offline Points: 16715 |

Posted: September 30 2008 at 13:55 Posted: September 30 2008 at 13:55 |

||

lol, crazy internet people. Well it seems that not passing the bailout was a good idea. 777 points, yeah! |

|||

|

if you own a sodastream i hate you

|

|||

|

|||

Post Reply

|

Page <1 34567 11> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |