/PAlogo_v2.gif) |

|

Post Reply

|

Page <1 56789 11> |

| Author | |||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 30 2008 at 10:31 Posted: September 30 2008 at 10:31 |

||

My understanding is that it was adjustable-rate loans with ridiculously low intro "teaser" rates that allowed most people to get into a house - fixed rate stuff would have been at too high an interest rate for them to afford it. Of course, either they didn't understand what they were getting into, or were duped, but either way when the rate skyrocketed after the teaser period they were obviously screwed. |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 30 2008 at 06:59 Posted: September 30 2008 at 06:59 |

||

Good article. Still I can't help but wonder how many of those who got the crappy subprime loans might not have defaulted if they had been given decent fixed rate loans. |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 30 2008 at 04:13 Posted: September 30 2008 at 04:13 |

||

|

I find that article to possibly be the most sensible and level-headed thing I've read about the crisis in a long time.

|

|||

|

|||

BroSpence

Forum Senior Member

Joined: March 05 2007 Status: Offline Points: 2614 |

Posted: September 30 2008 at 02:51 Posted: September 30 2008 at 02:51 |

||

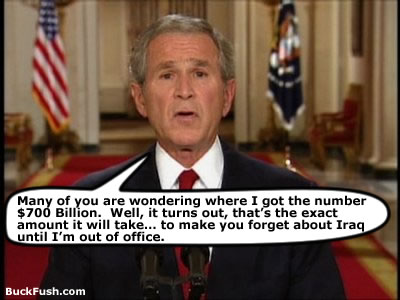

Yes the admin does love to tell people the sky is falling every time it wants something. I also love the new "developing story" of everyone shoving the blame around as to why the bill didn't pass. It was a poor bill, fear is in the heart of wall st. hence the big point drop, and Congress sucks. I found this commentary quite interesting: Another different look on the situation. |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 17:23 Posted: September 29 2008 at 17:23 |

||

I just noticed I misspelled consideration. Is consideratio anything like fellatio?  It is refreshing that politicians on both sides of the spectrum united to put a smack down on this.     September 29, 2008

Jonathan Schwarz:

This is Abraham Lincoln, then an Illinois state representative, speaking in the legislature on January 11, 1837. He’s referring to a dispute between private shareholders of the Illinois State Bank:

Lincoln’s speech was given just as one of the greatest speculative bubbles in US history was bursting. This was followed by the Panic of 1837, which led to a six-year contraction described by Milton Friedman as “the only depression on record comparable in severity and scope to the Great Depression.” Uncategorized | --> posted by Jonathan Schwarz at 8:26 AM |

link Edited by Slartibartfast - September 29 2008 at 21:20 |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

Eddy

Forum Senior Member

Joined: September 22 2004 Location: USA Status: Offline Points: 637 |

Posted: September 29 2008 at 17:03 Posted: September 29 2008 at 17:03 |

||

|

f**k the bailout.... it will go to the fatcats and theyll be sipping on a martini in athe bahamas while were suffer a major depression........ How many of you guys know that this is a ll part of the new world order??? Fuk the neocons and the democrats both parties are corrupt. obamas forin policy is almost the same as mcains its all a big lie guys....

|

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 29 2008 at 15:24 Posted: September 29 2008 at 15:24 |

||

Agreed. Still think something must be done, but this bill wasn't it. |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 15:18 Posted: September 29 2008 at 15:18 |

||

|

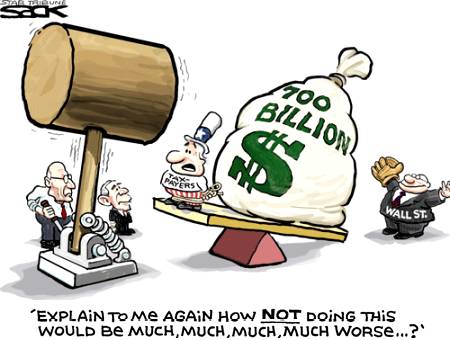

Thank God. This enormous chunk of change is not something that should be rushed through. And the options that spare the taxpayers the burden are really needing serious consideratio.

Edited by Slartibartfast - September 29 2008 at 23:18 |

|||

|

|||

Padraic

Special Collaborator

Honorary Collaborator Joined: February 16 2006 Location: Pennsylvania Status: Offline Points: 31169 |

Posted: September 29 2008 at 14:41 Posted: September 29 2008 at 14:41 |

||

|

|||

Tapfret

Special Collaborator

Honorary Collaborator / Retired Admin Joined: August 12 2007 Location: Bryant, Wa Status: Offline Points: 8581 |

Posted: September 29 2008 at 12:19 Posted: September 29 2008 at 12:19 |

||

|

Its simply just another Bush era corporate welfare program. The difference is, Bush is leaving office so he won't need to fork out another "economic stimulus check" to each taxpayer to make them forget about the previous round of corporate welfare programs. The American people have bent over and took it for this administration, and this is just one more shot for the road.

|

|||

|

|||

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 29 2008 at 08:02 Posted: September 29 2008 at 08:02 |

||

|

Since the great unveiling of the rescue plan yesterday, has anyone seen the presidential candidates clamouring for the glory?

It seems that they're not too keen to be associated with this package, strange really, as both of them seemed very eager to be hailed as saviours of the economy last week.

__________________________________

Apart from that: Why is everybody acting as if pumping 700 billion into the system will make the whole thing go away? The general opinion is that the banking crisis is far from over, we're possibly in the middle stage with other banking and insurance institutions' collapse still to follow. And what then? Edited by npjnpj - September 29 2008 at 08:17 |

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 29 2008 at 07:38 Posted: September 29 2008 at 07:38 |

||

|

This is interesting:

> "How to Bail Out Wall St. at No Cost to the TaxpayersThom Hartmann wrote an interesting piece on how to bail out Wall St. without costing the taxpayers a dime. The idea is to create a new government agency to manage the bailout. The treasury would then loan it money to bail out Wall St. firms that are in trouble. The government would then institute a Securities Turnover Excise Tax of 0.25% on stock trades with revenues going to the new agency. For long-term investors who buy stock in companies they believe in and keep it for years adding a quarter of 1% to the cost hardly matters, and even to speculators it is not huge. It is estimated that such a tax would generate at least $150 billion a year, so the $700 billion load would be paid off in 5 years. The US has had such a tax in the past and used it to finance the Civil War, Spanish-American War, WWI and WWII. Many other countries have a similar tax. This proposal is clearly a viable alternative to either giving Wall St. $700 billion as a freebie or even getting stock in return for the money. Wall St. managers might even prefer it to a plan that limited their future compensation. Mother Jones lists yet five more alternative bailout plans." The Votemaster But the president's on TV right now. They've apparently come to an agreement on the bailout. That can only mean one thing. We're going to get screwed again. Edited by Slartibartfast - September 29 2008 at 23:18 |

|||

|

|||

npjnpj

Forum Senior Member

Joined: December 05 2007 Location: Germany Status: Offline Points: 2720 |

Posted: September 29 2008 at 04:01 Posted: September 29 2008 at 04:01 |

||

|

Secureties, protection, segregated payments?

It's just double-talk, the same lot of bull, unchanged since last week, camouflaged ever so slightly to fool people into thinking there's a bit more substance to it.

I like the way George W. is using the age old weapon of scare tactics to get the public convinced that this is the only way to go. Old, but apparently still very effective. Smooth! Edited by npjnpj - September 29 2008 at 04:09 |

|||

|

|||

BroSpence

Forum Senior Member

Joined: March 05 2007 Status: Offline Points: 2614 |

Posted: September 29 2008 at 02:38 Posted: September 29 2008 at 02:38 |

||

|

So the "new" proposal has been released. Sounds like they took the same plan and split it into segments and supposedly added protections to it, for us? Still has to be passed though. And I guess its quite true. We have absolutely no say where our money is going.

|

|||

|

|||

IVNORD

Forum Senior Member

Joined: December 13 2006 Location: USA Status: Offline Points: 1191 |

Posted: September 29 2008 at 00:03 Posted: September 29 2008 at 00:03 |

||

And since I have no ideological preferences (unlike you) I can expand on the subject a bit more. If the Republicans were the patriots they claim they are, they would have stood up to this crap and put an end to this orgy long ago. But being the hypocritical pigs they are they could not stop this feast (which action would be immensely unpopular) for the fear of being voted out of office for the next few centuries. So they went along. After all it was good for bisiness, big business that is, who they are big supporters of, the fact they have the guts to admit sometimes. On the other hand the Democrats being the hypoctitical swine they are possess all nice qualities of the Republicans plus they have the temerity to claim they care about the common man.

|

|||

|

|||

debrewguy

Special Collaborator

Honorary Collaborator Joined: April 30 2007 Location: Canada Status: Offline Points: 3596 |

Posted: September 28 2008 at 12:21 Posted: September 28 2008 at 12:21 |

||

IS it a good guess on my part Slartibartfast, that you didn't have to Google-cheat to know this info ? Unlike some people here (myself included  ) ) |

|||

|

"Here I am talking to some of the smartest people in the world and I didn't even notice,” Lieutenant Columbo, episode The Bye-Bye Sky-High I.Q. Murder Case.

|

|||

|

|||

Slartibartfast

Collaborator

Honorary Collaborator / In Memoriam Joined: April 29 2006 Location: Atlantais Status: Offline Points: 29630 |

Posted: September 28 2008 at 07:55 Posted: September 28 2008 at 07:55 |

||

So can you tell me why exactly when the Republicans had control of the house and senate and then the house, senate, and the presidency (not to mention the supreme court) they didn't bother to take action to correct this? Lord knows they rammed through plenty of crap that wasn't good for this country. Oh, I get it, they were too busy pushing through crap that wasn't good for the country to attend to this matter.  When you point the finger you just may have three pointing back at you. Edited by Slartibartfast - September 28 2008 at 07:58 |

|||

|

Released date are often when it it impacted you but recorded dates are when it really happened...

|

|||

|

|||

JJLehto

Prog Reviewer

Joined: April 05 2006 Location: Tallahassee, FL Status: Offline Points: 34550 |

Posted: September 27 2008 at 23:20 Posted: September 27 2008 at 23:20 |

||

|

It WOULD be a good idea.....

but the government will f*ck it up.

Either accidentaly or on purpose (^ looking at crimhead's post)

Every week I see something else that pisses me off more

I want Socialism!!!!!

|

|||

|

|||

crimhead

Forum Senior Member

VIP Member Joined: October 10 2006 Location: Missouri Status: Offline Points: 19236 |

Posted: September 27 2008 at 18:48 Posted: September 27 2008 at 18:48 |

||

|

|||

|

|||

IVNORD

Forum Senior Member

Joined: December 13 2006 Location: USA Status: Offline Points: 1191 |

Posted: September 27 2008 at 13:05 Posted: September 27 2008 at 13:05 |

||

Saddest Thing About This Mess: Congress Had Chance To Stop ItBY TERRY JONES INVESTOR'S BUSINESS DAILY

Could the crisis at Fannie Mae (FNM) - Freddie Mac (FRE) and the subprime meltdown have been avoided? The answer is yes. As early as 1992, alarm bells were going off on the threat Fannie and Freddie posed to our financial system and our economy. Intervention at any point could have staved off today's crisis. But Democrats in Congress stood in the way. As the president recently said, Democrats have been "resisting any efforts by Republicans in the Congress or by me . . . to put some standards and tighten up a little on Fannie Mae and Freddie Mac." No, it wasn't President Bush who said that; it was President Clinton, Democrat, speaking just last week. Interesting, because it was his administration's relentless focus on multiculturalism that led to looser lending standards and regulatory pressure on banks to make mortgage loans to shaky borrowers. Freddie and Fannie, backed by an "implicit" taxpayer guarantee, bought hundreds of billions of dollars of those subprime loans. The mortgage giants, whose executive suites were top-heavy with former Democratic officials (and some Republicans), worked with Wall Street to repackage the bad loans and sell them to investors. As the housing market continued to fall in 2007, subprime loan portfolios suffered major losses. The crisis was on — though it was 15 years in the making. Democrats Blocked Reform Just as Republicans got blamed for Enron, WorldCom and other early-2000s scandals that were actually due to the anything-goes Clinton era, the media are now blaming them for the mortgage meltdown. But Republicans tried repeatedly to bring fiscal sanity to Fannie and Freddie. Democrats opposed them, especially Sen. Chris Dodd and Rep. Barney Frank, who now run Congress' key banking panels. History is utterly clear on this. After Treasury Secretary Lawrence Summers warned Congress in 1999 of the "systemic risk" posed by Fannie and Freddie, Congress held hearings the next year. But nothing was done. Why? Fannie and Freddie had donated millions to key congressmen and radical groups, ensuring no meaningful changes would take place. "We manage our political risk with the same intensity that we manage our credit and interest rate risks," Fannie CEO Franklin Raines, a former Clinton official and current Barack Obama adviser, bragged to investors in 1999. In November 2000, Clinton's HUD hailed "new regulations to provide $2.4 trillion in mortgages for affordable housing for 28.1 million families." It made Fannie and Freddie take part in the biggest federal expansion of housing aid ever. Soon after taking office, Bush had his hands full with the Clinton recession and 9/11. But by 2003, he proposed what the New York Times called "the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago." The plan included a new regulator for Fannie and Freddie, one that could boost capital mandates and look at how they managed risk. Even after regulators in 2003 uncovered a scheme by Fannie and Freddie executives to overstate earnings by $10.6 billion to boost bonuses, Democrats killed reform. "Fannie Mae and Freddie Mac are not facing any kind of financial crisis," said Rep. Frank, then-ranking Democrat on the Financial Services Committee. North Carolina Democrat Melvin Watt accused the White House of "weakening the bargaining power of poorer families and their ability to get affordable housing." In 2005, then-Fed Chairman Alan Greenspan told Congress: "We are placing the total financial system of the future at substantial risk." McCain Urged Changes That year, Sen. John McCain, one of three sponsors of a Fannie-Freddie reform bill, said: "If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system and the economy as a whole." Sen. Harry Reid — now Majority Leader — accused the GOP of trying to "cripple the ability of Fannie Mae and Freddie Mac to carry out their mission of expanding homeownership." The bill went nowhere. This year, the media have repeated Democrats' talking points about this being a "Republican" disaster. Well, McCain has repeatedly called for reforming the mortgage giants. The White House has repeatedly warned Congress. This year alone, Bush urged reform 17 times. Some GOP members are complicit. But Fannie and Freddie were created by Democrats, regulated by Democrats, largely run by Democrats and protected by Democrats. That's why taxpayers are now being asked for $700 billion. |

|||

|

|||

Post Reply

|

Page <1 56789 11> |

| Forum Jump | Forum Permissions  You cannot post new topics in this forum You cannot reply to topics in this forum You cannot delete your posts in this forum You cannot edit your posts in this forum You cannot create polls in this forum You cannot vote in polls in this forum |